ADT 2015 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2015 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

OTHER MATTERS

OTHER MATTERS

Registered and Principal Executive Offices

The registered and principal executive offices of The ADT Corporation are located at 1501 Yamato Road, Boca Raton, Florida 33431 and its

telephone number is (561) 988-3600.

Householding of Proxy Materials

SEC rules permit companies and intermediaries such as brokers to satisfy delivery requirements for proxy statements and notices with respect to

two or more stockholders sharing the same address by delivering a single proxy statement or a single notice addressed to those stockholders.

This process, which is commonly referred to as “householding,” provides cost savings for companies. Some brokers household proxy materials,

delivering a single proxy statement or notice to multiple stockholders sharing an address unless contrary instructions have been received from an

affected stockholder. Once you have received notice from your broker that they will be householding materials to your address, householding will

continue until you are notified otherwise or until you revoke your consent. If, at any time, you no longer wish to participate in householding and

would prefer to receive a separate proxy statement or notice, or if your household is receiving multiple copies of these documents and you wish

to request that future deliveries be limited to a single copy, please notify your broker. You can request prompt delivery of a copy of the proxy

materials by writing to: Broadridge, Attention Householding Dept., 51 Mercedes Way, Edgewood, NY 11711 or by calling 1-800-542-1061.

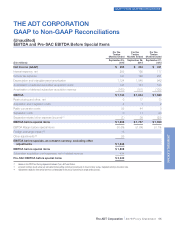

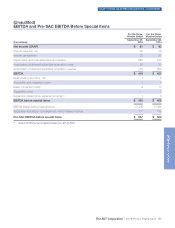

RECONCILIATION OF NON-GAAP MEASURES TO

GAAP MEASURES AND SELECTED DEFINITIONS

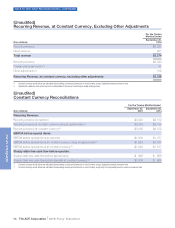

Recurring revenue in constant currency, earnings before interest, taxes, depreciation and amortization (EBITDA), EBITDA in constant currency,

EBITDA Margin, pre-SAC EBITDA, pre-SAC EBITDA margin, and steady-state free cash flow (SSFCF), in each case “before special items,” are

non-GAAP measures that may be used from time to time and should not be considered replacements for GAAP results.

Recurring revenue in constant currency is a useful measure because it provides transparency to the underlying performance in markets outside

the United States by excluding the effect that foreign currency exchange rate fluctuations have on comparability. Recurring revenue in constant

currency as presented herein may not be comparable to similarly titled measures reported by other companies. The difference between revenue

(the most comparable GAAP measure) and recurring revenue in constant currency (the non-GAAP measure) is the exclusion of the impact of

foreign currency exchange fluctuations. This is also the primary limitation of this measure, which is best addressed by using recurring revenue in

constant currency in combination with GAAP revenue.

EBITDA is a useful measure of the Company’s success in acquiring, retaining and servicing our customer base and ability to generate and grow

recurring revenue while providing a high level of customer service in a cost-effective manner. The difference between Net Income (the most

comparable GAAP measure) and EBITDA (the non-GAAP measure) is the exclusion of interest expense, the provision for income taxes,

depreciation and amortization expense. Excluding these items eliminates the impact of expenses associated with our capitalization and tax

structure as well as the impact of non-cash charges related to capital investments.

Pre-SAC EBITDA is useful because it measures the Company’s operational profits from its existing customer base by excluding certain revenue

and expenses related to acquiring new customers. The difference between Net Income (the most comparable GAAP measure) and pre-SAC

EBITDA (the non-GAAP measure) is the exclusion of interest expense, the provision for income taxes, depreciation expense, amortization

expense, gross subscriber acquisition cost expenses and revenue associated with the sale of equipment. Excluding these items eliminates the

impact of expenses associated with our capitalization and tax structure, the impact of non-cash charges related to capital investments and the

impact of growing our subscriber base.

In addition, from time to time, the Company may present EBITDA and pre-SAC EBITDA before special items, which are the respective measures

adjusted to exclude the impact of the items highlighted below. These numbers provide information to investors regarding the impact of certain

items management believes are useful to identify, as described below. EBITDA and pre-SAC EBITDA may also be presented at constant

currency. Constant currency presentation is useful because it provides transparency to the underlying performance in markets outside the U.S.

by excluding the effect that foreign currency exchange rate fluctuations have on comparability.

There are material limitations to using EBITDA and pre-SAC EBITDA. EBITDA and pre-SAC EBITDA may not be comparable to similarly titled

measures reported by other companies. Furthermore, EBITDA and pre-SAC EBITDA does not take into account certain significant items,

including depreciation and amortization, interest expense and tax expense, which directly affect our net income. Additionally, pre-SAC EBITDA

does not take into account expenses related to acquiring new customers. These limitations are best addressed by considering the economic

effects of the excluded items independently, and by considering EBITDA and pre-SAC EBITDA in conjunction with net income as calculated in

accordance with GAAP. The EBITDA and pre-SAC EBITDA discussion above is also applicable to the respective margin measures.

The ADT Corporation 2016 Proxy Statement 53

PROXY STATEMENT