ADT 2015 Annual Report Download - page 158

Download and view the complete annual report

Please find page 158 of the 2015 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FORM 10-K

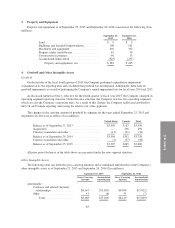

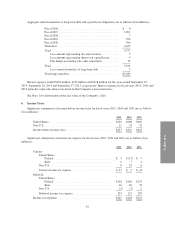

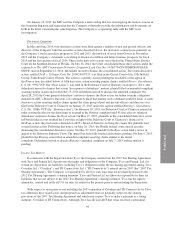

The changes in the net carrying amount of contracts and related customer relationships for the years ended

September 25, 2015 and September 26, 2014 are as follows ($ in millions):

Balance as of September 27, 2013 ............................... $2,917

Acquisition of customer relationships ............................ 253

Customer contract additions, net of dealer charge-backs .............. 523

Amortization ................................................ (587)

Currency translation and other .................................. (30)

Balance as of September 26, 2014 ............................... $3,076

Customer contract additions, net of dealer charge-backs .............. 561

Amortization ................................................ (614)

Currency translation and other .................................. (59)

Balance as of September 25, 2015 ............................... $2,964

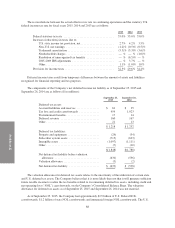

Other than goodwill, the Company does not have any other indefinite-lived intangible assets as of

September 25, 2015 and September 26, 2014. Intangible asset amortization expense for fiscal years 2015, 2014

and 2013 was $617 million, $589 million and $569 million, respectively. The weighted-average amortization

periods for contracts and related customer relationships acquired during fiscal years 2015 and 2014 were 15 and

14 years, respectively.

The estimated aggregate amortization expense for intangible assets is expected to be as follows ($ in

millions):

Fiscal 2016 .......................................... $571

Fiscal 2017 .......................................... 476

Fiscal 2018 .......................................... 398

Fiscal 2019 .......................................... 342

Fiscal 2020 .......................................... 274

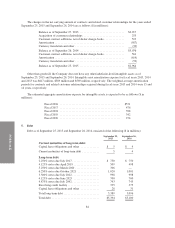

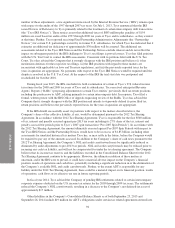

5. Debt

Debt as of September 25, 2015 and September 26, 2014 consisted of the following ($ in millions):

September 25,

2015

September 26,

2014

Current maturities of long-term debt:

Capital lease obligations and other ............. $ 5 $ 4

Current maturities of long-term debt ............ 5 4

Long-term debt:

2.250% notes due July 2017 ................... $ 750 $ 750

4.125% notes due April 2019 .................. 509 498

5.250% notes due March 2020 ................. 306 —

6.250% notes due October 2021 ............... 1,020 1,001

3.500% notes due July 2022 ................... 998 998

4.125% notes due June 2023 .................. 700 700

4.875% notes due July 2042 ................... 743 743

Revolving credit facility ...................... 335 375

Capital lease obligations and other ............. 28 31

Total long-term debt ......................... 5,389 5,096

Total debt ................................. $5,394 $5,100

84