ADT 2015 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2015 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FORM 10-K

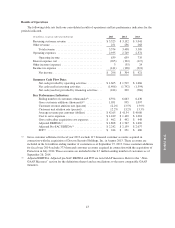

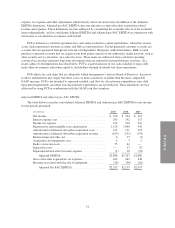

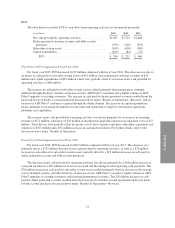

Adjusted EBITDA and Adjusted pre-SAC EBITDA by segment for fiscal years 2015, 2014 and 2013 was as

follows:

(in millions) 2015 2014 2013

Adjusted EBITDA:

United States ...................................... $1,685 $1,671 $1,592

Canada ........................................... 123 96 98

Total ......................................... $1,808 $1,767 $1,690

Adjusted pre-SAC EBITDA:

United States ...................................... $2,093 $2,043 $1,960

Canada ........................................... 149 116 117

Total ......................................... $2,242 $2,159 $2,077

Fiscal Year 2015 Compared to Fiscal Year 2014

United States

For fiscal year 2015, Adjusted EBITDA and Adjusted pre-SAC EBITDA increased by $14 million and $50

million, respectively, as compared to fiscal year 2014. These increases were primarily due to higher recurring

revenue of $103 million, partially offset by increased cost to serve expenses of $55 million, which were adjusted

to exclude an $11 million increase in radio conversion costs, a $12 million decrease in restructuring and other

charges as well as a $5 million decrease in acquisition and integration costs. The increase in Adjusted EBITDA

was also partially offset by increased advertising costs of $31 million, which was largely attributable to dealer

lead generation activities under a marketing efficiency program.

Canada

For fiscal year 2015, Adjusted EBITDA and Adjusted pre-SAC EBITDA increased by $27 million and $33

million, respectively, as compared to fiscal year 2014. The increase was primarily due to higher recurring

revenue of $68 million, partially offset by increased cost to serve expenses of $38 million. These increases

primarily related to incremental revenue and costs associated with the acquisition and operations of Protectron,

partially offset by the negative impact of foreign currency exchange rates.

For further details on the drivers of these changes, refer to the discussion above under “Results of

Operations.”

Fiscal Year 2014 Compared to Fiscal Year 2013

United States

For fiscal year 2014, Adjusted EBITDA and Adjusted pre-SAC EBITDA increased by $79 million and $83

million, respectively, as compared with fiscal year 2013. The increase was due primarily to higher recurring

revenue of $98 million, partially offset by increased cost to serve expenses of $18 million, which were adjusted

to exclude a $44 million increase in radio conversion costs, $17 million increase in restructuring and other

charges as well as a $5 million increase in acquisition and integration costs.

For further details on the drivers of these changes, refer to the discussion above under “Results of

Operations.”

52