ADT 2015 Annual Report Download - page 150

Download and view the complete annual report

Please find page 150 of the 2015 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FORM 10-K

Early termination of the contract by the customer results in a termination charge in accordance with the

customer contract, which is recognized when collectability is reasonably assured. Contract termination charges

recognized in revenue during fiscal years 2015, 2014 and 2013 were not material.

Advertising—Advertising costs which amounted to $199 million, $168 million and $163 million for fiscal

years 2015, 2014 and 2013, respectively, are expensed when incurred and are included in selling, general and

administrative expenses.

Radio Conversion Costs—During fiscal year 2013, the Company implemented a three-year conversion

program to replace 2G cellular technology used in many of its security systems, and began incurring costs under

this program in fiscal year 2014. The Company incurred charges of $55 million and $44 million in fiscal years

2015 and 2014, respectively, related to the conversion program. These costs are reflected in radio conversion

costs in the Consolidated Statements of Operations.

Separation Costs—Effective on September 28, 2012 (the “Distribution Date”), Tyco International Ltd.

(“Tyco”) distributed to its public stockholders the Company’s common stock (the “Separation”), and the

Company became an independent public company. Charges incurred directly related to the Separation are

reflected in separation costs in the Company’s Consolidated Statements of Operations.

Other Income (Expense)—During fiscal year 2015, there was no material activity in other income (expense).

During fiscal year 2014, the Company recorded $35 million of other expense, which is comprised primarily of

$38 million of non-taxable expense representing a reduction in the receivable from Tyco pursuant to the tax

sharing agreement entered into in conjunction with the Separation largely due to the resolution of certain

components of the Company’s unrecognized tax benefits. During fiscal year 2013, the Company recorded $24

million of other income, which is comprised primarily of $23 million of non-taxable income recorded pursuant to

the tax sharing agreement for amounts owed by Tyco and Pentair Ltd. in connection with the exercise of ADT

share based awards held by certain Tyco and Pentair Ltd. employees. See Note 6 for further information.

Translation of Foreign Currency—The Company’s Consolidated Financial Statements are reported in U.S.

dollars. A portion of the Company’s business is transacted in Canadian dollars. The Company’s Canadian entities

maintain their records in Canadian dollars. The assets and liabilities are translated into U.S. dollars using rates of

exchange at the balance sheet date and translation adjustments are recorded in accumulated other comprehensive

income. Revenue and expenses are translated at average rates of exchange in effect during the year.

Cash and Cash Equivalents—All highly liquid investments with original maturities of three months or less

from the time of purchase are considered to be cash equivalents.

Allowance for Doubtful Accounts—The allowance for doubtful accounts receivable reflects the best estimate

of probable losses inherent in the Company’s receivable portfolio determined on the basis of historical

experience and other currently available evidence.

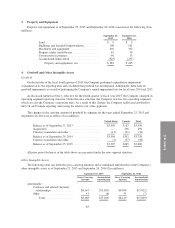

Inventories—Inventories are recorded at the lower of cost (average cost) or market value. Inventories

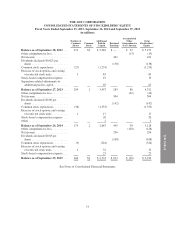

consisted of the following ($ in millions):

September 25,

2015

September 26,

2014

Work in progress ........................... $ 3 $ 2

Finished goods ............................. 73 74

Inventories ............................ $76 $76

Property and Equipment, Net—Property and equipment, net is recorded at cost less accumulated

depreciation. Depreciation expense on property and equipment for fiscal years 2015, 2014 and 2013 was $71

76