ADT 2015 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2015 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

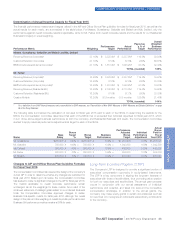

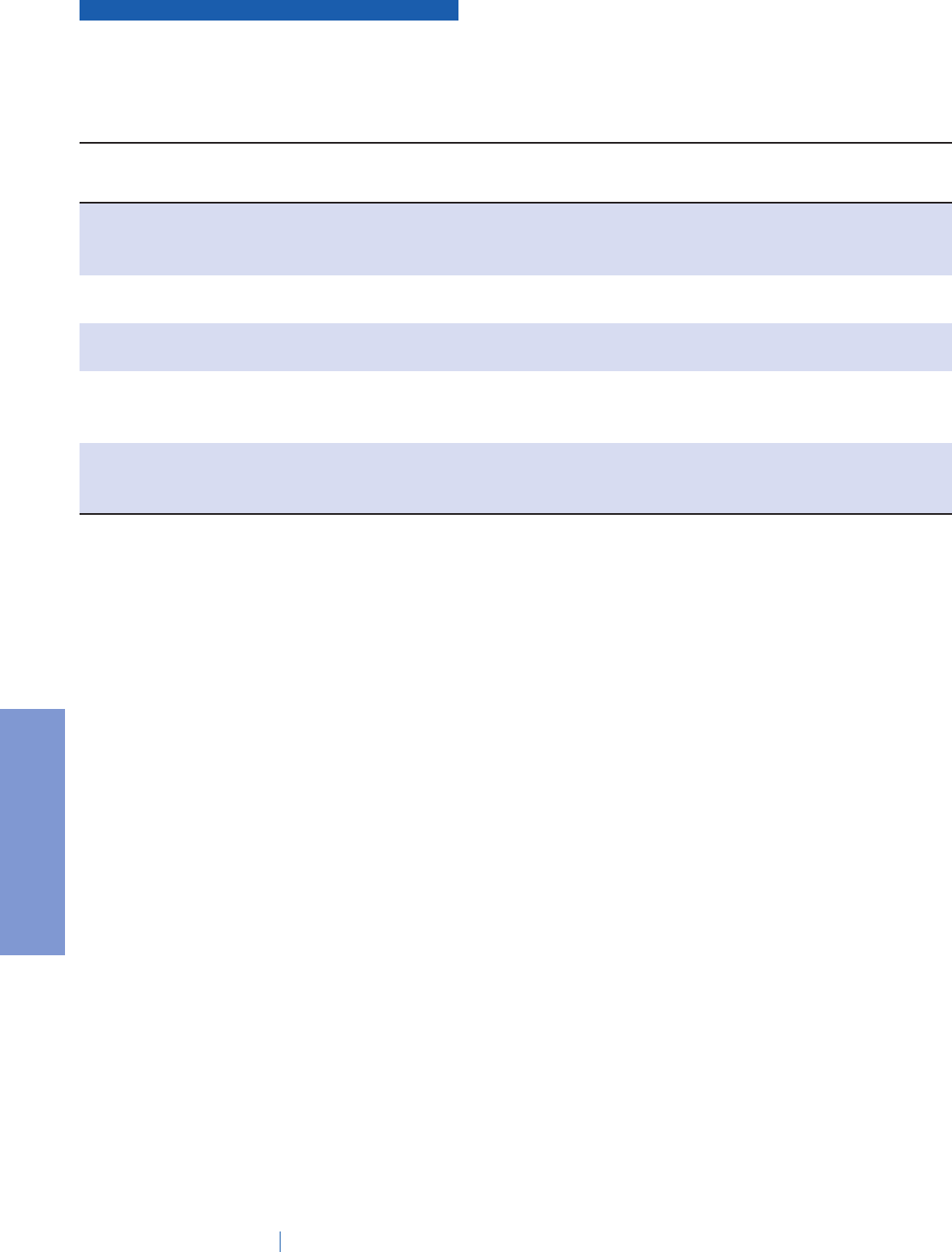

FISCAL YEAR 2015 NEO COMPENSATION—CONTINUED

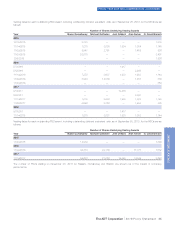

Summary Compensation Table—All Other Compensation

The components of the “All Other Compensation” column in the Summary Compensation Table for each NEO are shown in the following table.

Named Executive Fiscal

Year

Tax

Gross-Ups

($) (a)

Retirement

Plan

Contributions

($) (b) Miscellaneous

($) (c)

Total All Other

Compensation

($)

Naren Gursahaney 2015 — 76,502 — 76,502

2014 — 68,400 2,000 70,400

2013 52,165 53,607 161,514 267,286

Michael Geltzeiler 2015 14,632 64,664 1,860 81,156

2014 20,391 17,972 63,694 102,057

Jerri DeVard 2015 29,184 14,695 19,857 63,736

2014 18,189 6,458 65,905 90,552

Alan Ferber 2015 — 33,218 2,496 35,714

2014 — 20,873 2,102 22,975

2013 5,699 7,500 34,644 47,843

N. David Bleisch 2015 10,971 31,840 — 42,811

2014 75,140 29,415 232,976 337,531

2013 4,993 24,868 96,543 126,404

(a) The amounts shown in this column as tax gross-up payments for Messrs. Gursahaney, Geltzeiler, Ferber and Bleisch and Ms. DeVard represent tax gross-up payments made with respect to

taxable relocation expenses.

(b) Amounts represent matching contributions made by the Company on behalf of each NEO to its tax-qualified 401(k) RSIP and to its non-qualified SSRP, as applicable.

(c) Miscellaneous compensation in fiscal year 2015 includes the value of taxable relocation benefits for Ms. DeVard (totaling $17,638), as well as the value of an executive physical for Messrs.

Geltzeiler and Ferber and Ms. DeVard. Miscellaneous compensation in fiscal year 2014 includes the value of taxable relocation benefits for Messrs. Geltzeiler, Ferber and Bleisch and

Ms. DeVard (totaling $63,244; $2,102; $232,976; and $65,905, respectively), as well as the value of an executive physical for Messrs. Gursahaney and Geltzeiler. In fiscal year 2013,

miscellaneous compensation for Messrs. Gursahaney, Ferber and Bleisch includes the value of taxable relocation benefits (totaling $161,514; $34,644; and $95,293, respectively), as well as

the value of an executive physical for Mr. Bleisch.

40 The ADT Corporation 2016 Proxy Statement

PROXY STATEMENT