ADT 2015 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2015 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FORM 10-K

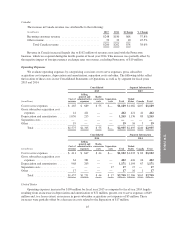

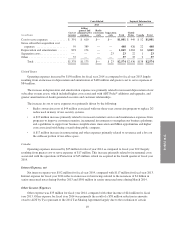

The increase in depreciation and amortization expense was primarily driven by additional depreciation

expense on subscriber system assets, which included higher costs associated with ADT Pulse®additions and

upgrades, and greater amortization of dealer generated accounts and customer relationships.

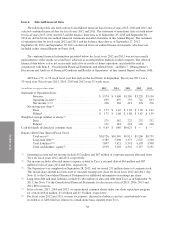

The increase in cost to serve expenses was primarily driven by the following:

• Increased costs of $47 million largely related to greater maintenance and customer service expenses

due primarily to a higher mix of ADT Pulse®customers, as well as efforts to enhance our customer

care and service response, and higher bad debt expense.

• Increased radio conversion costs of $11 million, related to a three-year conversion program for the

replacement of 2G radios used in many of our security systems which will continue to drive future

incremental costs. We expect to complete this program by the end of calendar year 2016 and anticipate

that we will incur approximately $85 million to $105 million of remaining costs in conjunction with

this program.

These increases were partially offset by a decrease in restructuring and other expenses of $12 million.

Restructuring and other expenses in fiscal year 2014 primarily related to severance and a loss on the

sublease portion of our office space.

Gross subscriber acquisition cost expenses were relatively flat and included the following:

• Increased advertising costs of $31 million, which were largely attributable to $25 million of dealer lead

generation activities under a marketing efficiency program.

• Decreased installation costs on outright system sales to our business customers of $28 million due to a

mix shift from video equipment sales to ADT-owned hosted video solutions, resulting in higher

deferred costs and lower current period installation costs.

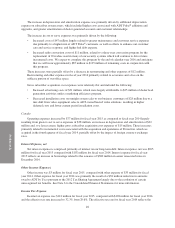

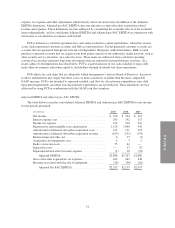

Canada

Operating expenses increased by $77 million for fiscal year 2015 as compared to fiscal year 2014 largely

resulting from greater cost to serve expenses of $38 million, an increase in depreciation and amortization of $22

million and, to a lesser extent, higher gross subscriber acquisition cost expenses of $15 million. These increases

primarily related to incremental costs associated with the acquisition and operations of Protectron, which we

acquired in the fourth quarter of fiscal year 2014, partially offset by the impact of foreign currency exchange

rates.

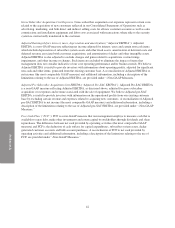

Interest Expense, net

Net interest expense is comprised primarily of interest on our long-term debt. Interest expense, net was $205

million for fiscal year 2015 compared with $192 million for fiscal year 2014. Interest expense for fiscal year

2015 reflects an increase in borrowings related to the issuance of $300 million in senior unsecured notes in

December 2014.

Other Income (Expense)

Other income was $3 million for fiscal year 2015, compared with other expense of $35 million for fiscal

year 2014. Other expense for fiscal year 2014 was primarily the result of a $38 million reduction in amounts

owed to ADT by Tyco pursuant to the 2012 Tax Sharing Agreement largely due to the resolution of certain

unrecognized tax benefits. See Note 6 to the Consolidated Financial Statements for more information.

Income Tax Expense

Income tax expense was $141 million for fiscal year 2015, compared with $128 million for fiscal year 2014,

and the effective tax rate increased to 32.3% from 29.6%. The effective tax rate for fiscal year 2014 reflects the

46