ADT 2015 Annual Report Download - page 129

Download and view the complete annual report

Please find page 129 of the 2015 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FORM 10-K

open market repurchases for fiscal year 2015 was $324 million, all of which was paid during fiscal year 2015. As

of September 25, 2015, $57 million remains authorized for repurchase under the FY2013 Share Repurchase

Program.

On July 17, 2015, our Board of Directors approved a new share repurchase program (“FY2015 Share

Repurchase Program”) authorizing us to repurchase up to $1 billion of our common stock, which is incremental

to the remaining amounts authorized to be repurchased under the FY2013 Share Repurchase Program. Pursuant

to this approval, we may enter into accelerated share repurchase plans, as well as repurchase shares on the open

market pursuant to pre-set trading plans meeting the requirements of Rule 10b5-1 under the Securities Exchange

Act of 1934, in private transactions or otherwise. The FY2015 Share Repurchase Program expires on July 17,

2018, and may be terminated at any time. As of September 25, 2015, no shares have been repurchased under the

approved FY2015 Share Repurchase Program.

Dividends

On November 19, 2014, we paid a quarterly dividend on our common stock of $0.20 per share to

stockholders of record on October 29, 2014. This dividend was declared on September 19, 2014.

During fiscal year 2015, our Board of Directors declared the following dividends on our common stock:

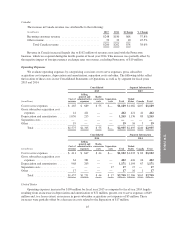

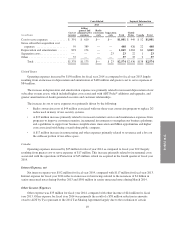

Declaration Date

Dividend

per Share Record Date Payment Date

July 17, 2015 $0.21 July 29, 2015 August 19, 2015

March 17, 2015 $0.21 April 29, 2015 May 20, 2015

January 8, 2015 $0.21 January 28, 2015 February 18, 2015

We paid $142 million in dividend payments on our common stock during fiscal year 2015.

On October 14, 2015, our Board of Directors declared a quarterly dividend on our common stock of $0.21

per share to stockholders of record on October 28, 2015. This dividend will be paid on November 18, 2015.

Whether our Board of Directors exercises its discretion to approve any dividends in the future will depend

on many factors, including our financial condition, capital requirements of our business, covenants associated

with debt obligations, legal requirements, regulatory constraints, industry practice and other factors that our

Board of Directors deems relevant. Therefore, we can make no assurance that we will pay a dividend in the

future.

Cash Flow Analysis

The following table is a summary of our cash flow activity for fiscal years 2015, 2014 and 2013:

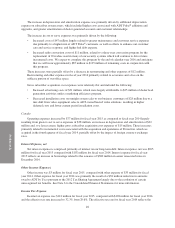

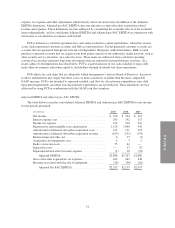

(in millions) 2015 2014 2013

Net cash provided by operating activities .............. $1,605 $ 1,519 $ 1,666

Net cash used in investing activities .................. $(1,406) $(1,792) $(1,394)

Net cash (used in) provided by financing activities ....... $ (184) $ 202 $ (366)

Cash Flows from Operating Activities

For fiscal years 2015, 2014 and 2013, we reported net cash provided by operating activities of $1.6 billion,

$1.5 billion and $1.7 billion, respectively. See discussion of changes in net cash provided by operating activities

included in FCF under “Results of Operations—Non-GAAP Measures.”

55