ADT 2015 Annual Report Download - page 159

Download and view the complete annual report

Please find page 159 of the 2015 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FORM 10-K

Senior Unsecured Notes

Fiscal Year 2015

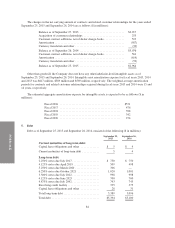

On December 18, 2014, the Company completed a public offering of $300 million of its 5.250% senior

unsecured notes due March 15, 2020 (the “December 2014 Debt Offering”). Net cash proceeds from the issuance

of this term indebtedness totaled $296 million and were primarily used to repay outstanding borrowings under

the Company’s revolving credit facility and for general corporate purposes. Interest is payable on March 15 and

September 15 of each year and commenced on March 15, 2015. The Company may redeem the notes, in whole or

in part, at any time prior to the maturity date at a redemption price equal to the greater of the principal amount of

the notes to be redeemed or a make-whole premium, plus in each case, accrued and unpaid interest to, but

excluding, the redemption date.

Additionally, in December 2014, the Company entered into interest rate swap transactions on all $300

million of the December 2014 Debt Offering. These transactions are designated as fair value hedges with the

objective of managing the exposure to interest rate risk by converting the interest rates on the fixed-rate notes to

floating rates. These transactions did not have a material impact on the Company’s Consolidated Financial

Statements as of September 25, 2015.

Fiscal Year 2014

On October 1, 2013, the Company issued $1 billion aggregate principal amount of 6.250% senior unsecured

notes due October 2021 in a private placement conducted pursuant to Rule 144A and Regulation S under the

Securities Act of 1933, as amended (the “October 2013 Debt Offering”). Net cash proceeds from the issuance of

this term indebtedness totaled $987 million, of which $150 million was used to repay the outstanding borrowings

under the Company’s revolving credit facility. The remaining net proceeds were used primarily for repurchases

of outstanding shares of ADT’s common stock. Interest is payable on April 15 and October 15 of each year and

commenced on April 15, 2014. The Company may redeem the notes, in whole or in part, at any time prior to the

maturity date at a redemption price equal to the greater of the principal amount of the notes to be redeemed, or a

make-whole premium, plus in each case, accrued and unpaid interest to, but excluding, the redemption date. In

connection with the October 2013 Debt Offering, the Company entered into an exchange and registration rights

agreement with the initial purchasers, and on April 4, 2014 the Company commenced an offer to exchange the $1

billion notes. This exchange offer was completed on May 9, 2014.

On March 19, 2014, the Company completed a public offering of $500 million of its 4.125% senior

unsecured notes due April 2019. Net cash proceeds from the issuance of this term indebtedness totaled $493

million, of which $200 million was used to repay outstanding borrowings under the Company’s revolving credit

facility. The remaining net proceeds were used primarily for general corporate purposes and repurchases of

outstanding shares of ADT’s common stock. Interest is payable on April 15 and October 15 of each year, and

commenced on October 15, 2014. The Company may redeem the notes, in whole or in part, at any time prior to

the maturity date at a redemption price equal to the greater of the principal amount of the notes to be redeemed,

or a make-whole premium, plus in each case, accrued and unpaid interest to, but excluding, the redemption date.

Additionally, during the year ended September 26, 2014, the Company entered into interest rate swap

transactions to hedge $500 million of its $1 billion October 2013 Debt Offering, and all $500 million of its

4.125% fixed-rate notes due April 2019. These transactions are designated as fair value hedges with the objective

of managing the exposure to interest rate risk by converting the interest rates on the fixed-rate notes to floating

rates. These transactions did not have a material impact on the Company’s Consolidated Financial Statements as

of September 25, 2015 and September 26, 2014.

85