ADT 2015 Annual Report Download - page 125

Download and view the complete annual report

Please find page 125 of the 2015 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FORM 10-K

expense, tax expense and other adjustments which directly affect our net income. In addition to the Adjusted

EBITDA limitations, Adjusted pre-SAC EBITDA does not take into account subscriber acquisition related

revenue and expenses. These limitations are best addressed by considering the economic effects of the excluded

items independently, and by considering Adjusted EBITDA and Adjusted pre-SAC EBITDA in conjunction with

net income as calculated in accordance with GAAP.

FCF is defined as cash from operations less cash outlays related to capital expenditures, subscriber system

assets, dealer generated customer accounts and bulk account purchases. Dealer generated customer accounts are

accounts that are generated through our network of independent, third-party authorized dealers. Bulk account

purchases represent accounts that we acquire from third parties outside of our authorized, dealer network, such as

other security service providers, on a selective basis. These items are subtracted from cash from operating

activities because they represent long-term investments that are required for normal business activities. As a

result, subject to the limitations described below, FCF is a useful measure of our cash available to repay debt,

make other investments and return capital to stockholders through dividends and share repurchases.

FCF adjusts for cash items that are ultimately within management’s and our Board of Directors’ discretion

to direct and therefore may imply that there is less or more cash that is available than the most comparable

GAAP measure. FCF is not intended to represent residual cash flow for discretionary expenditures since debt

repayment requirements and other non-discretionary expenditures are not deducted. These limitations are best

addressed by using FCF in combination with the GAAP cash flow numbers.

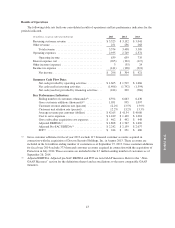

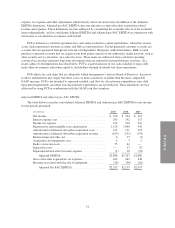

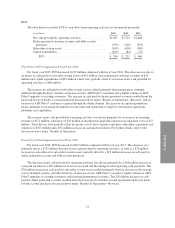

Adjusted EBITDA and Adjusted pre-SAC EBITDA

The table below reconciles consolidated Adjusted EBITDA and Adjusted pre-SAC EBITDA to net income

for the periods presented.

(in millions) 2015 2014 2013

Net income ........................................ $ 296 $ 304 $ 421

Interest expense, net ................................. 205 192 117

Income tax expense ................................. 141 128 221

Depreciation and intangible asset amortization ............ 1,124 1,040 942

Amortization of deferred subscriber acquisition costs ....... 141 131 123

Amortization of deferred subscriber acquisition revenue .... (163) (151) (135)

Restructuring and other, net ........................... 6 17 (1)

Acquisition and integration costs .......................472

Radio conversion costs ............................... 55 44 —

Separation costs .................................... — 17 23

Separation related other (income) expense ............... (1) 38 (23)

Adjusted EBITDA .............................. $1,808 $1,767 $1,690

Gross subscriber acquisition cost expenses ............... 462 442 448

Revenue associated with the sale of equipment ............ (28) (50) (61)

Adjusted Pre-SAC EBITDA ...................... $2,242 $2,159 $2,077

51