ADT 2015 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2015 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FORM 10-K

unrecognized tax benefits. Other income for fiscal year 2013 was primarily the result of $23 million in non-

taxable income recorded pursuant to the 2012 Tax Sharing Agreement for amounts owed by Tyco and Pentair in

connection with the exercise of ADT share based awards held by certain Tyco and Pentair employees. See Note 6

to the Consolidated Financial Statements for more information.

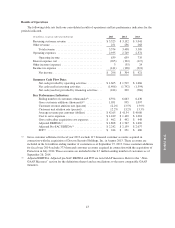

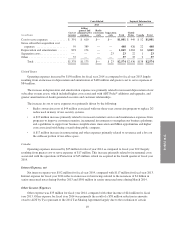

Income Tax Expense

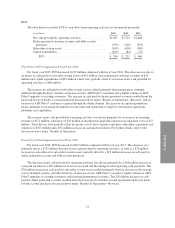

Income tax expense was $128 million for fiscal year 2014, compared with $221 million for fiscal year 2013,

and the effective tax rate decreased to 29.6% from 34.4%. The effective tax rate for fiscal year 2014 reflects the

net impact of a $42 million favorable adjustment resulting from the resolution of certain unrecognized tax

benefits partially offset by the unfavorable deferred tax impact of $17 million from IRS audit adjustments.

Additionally, the fiscal year 2014 effective tax rate reflects the unfavorable impact resulting from $38 million in

non-deductible expense. See “Other Income (Expense)” above.

The effective tax rate can vary from period to period due to permanent tax adjustments, discrete items such

as the settlement of income tax audits and changes in tax laws, as well as recurring factors such as changes in the

overall effective state tax rate.

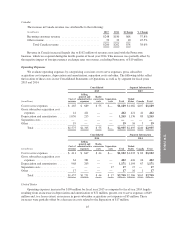

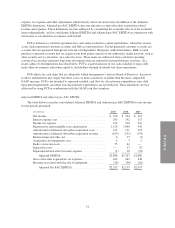

Non-GAAP Measures

To provide investors with additional information in connection with our results as determined by GAAP, we

also disclose non-GAAP measures which management believes provide useful information to investors. These

measures consist of Adjusted EBITDA, Adjusted pre-SAC EBITDA, and FCF. These measures are not financial

measures calculated in accordance with GAAP and should not be considered as substitutes for net income,

operating profit, cash from operating activities or any other operating performance measure calculated in

accordance with GAAP, and they may not be comparable to similarly titled measures reported by other

companies. We use Adjusted EBITDA and Adjusted pre-SAC EBITDA to measure the operational strength and

performance of our business. We use FCF as an additional measure of our ability to repay debt, make other

investments and return capital to stockholders through dividends and share repurchases. These measures, or

measures that are based on them, may also be used as components in our incentive compensation plans.

We believe Adjusted EBITDA is useful because it measures our success in acquiring, retaining and

servicing our customer base and our ability to generate and grow our recurring revenue while providing a high

level of customer service in a cost-effective manner. Adjusted EBITDA excludes interest expense and the

provision for income taxes. Excluding these items eliminates the expenses associated with our capitalization and

tax structure. Because Adjusted EBITDA excludes interest expense, it does not give effect to cash used for debt

service requirements and thus does not reflect available funds for distributions, reinvestment or other

discretionary uses. Adjusted EBITDA also excludes depreciation and amortization, which eliminates the impact

of non-cash charges related to capital investments. Depreciation and amortization includes depreciation of

subscriber system assets and other fixed assets, amortization of deferred costs and deferred revenue associated

with subscriber acquisitions and amortization of dealer and other intangible assets. Adjusted EBITDA is also

adjusted to exclude charges and gains related to acquisitions, restructurings, impairments, and other income or

charges. Such items are excluded to eliminate the impact of items that management does not consider indicative

of our core operating performance and/or business trends.

We believe Adjusted pre-SAC EBITDA is useful because it measures the operational profits from our

existing customer base by excluding certain revenue and expenses related to acquiring new customers. Adjusted

Pre-SAC EBITDA reflects Adjusted EBITDA, as discussed above, adjusted for gross subscriber acquisition cost

expenses and revenue associated with the sale of equipment. Excluding subscriber acquisition related revenue

and expenses eliminates the impact of growing our subscriber base.

There are material limitations to using Adjusted EBITDA and Adjusted pre-SAC EBITDA. Adjusted

EBITDA does not take into account certain significant items, including depreciation and amortization, interest

50