ADT 2015 Annual Report Download - page 166

Download and view the complete annual report

Please find page 166 of the 2015 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FORM 10-K

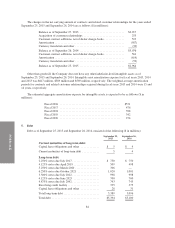

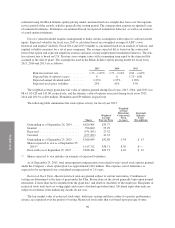

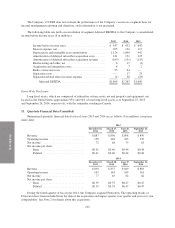

The purchase obligations in the table above primarily relate to an agreement with one of the Company’s

suppliers for the purchase of certain security system equipment and components. The agreement, which was

amended during the third quarter of fiscal year 2015, provides that the Company meet minimum purchase

requirements, which are subject to adjustments based on certain performance conditions for each of the calendar

years 2015, 2016, and 2017. The agreement expires on December 31, 2017.

Legal Proceedings

The Company is subject to various claims and lawsuits in the ordinary course of business, including from

time to time, contractual disputes, employment matters, product and general liability claims, claims that the

Company has infringed on the intellectual property rights of others, claims related to alleged security system

failures, and consumer and employment class actions. In the ordinary course of business, the Company is also

subject to regulatory and governmental examinations, information requests and subpoenas, inquiries,

investigations and threatened legal actions and proceedings. In connection with such formal and informal

inquiries, the Company receives numerous requests, subpoenas and orders for documents, testimony and

information in connection with various aspects of its activities. The Company has recorded accruals for losses

that it believes are probable to occur and are reasonably estimable. While the ultimate outcome of these matters

cannot be predicted with certainty, the Company believes that the resolution of any such proceedings (other than

matters specifically identified below), will not have a material effect on its financial position, results of

operations or cash flows.

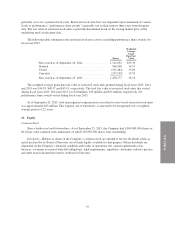

Environmental Matter

On October 25, 2013, the Company was notified by subpoena that the Office of the Attorney General of

California, in conjunction with the Alameda County District Attorney, is investigating whether certain of the

Company’s waste disposal policies, procedures and practices are in violation of the California Business and

Professions Code and the California Health and Safety Code. The Company is cooperating fully with the

respective authorities. The Company is currently unable to predict the outcome of this investigation or reasonably

estimate a range of possible loss.

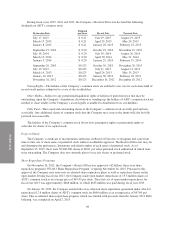

Securities Litigation

On April 28, 2014, the Company and certain of its current and former officers and directors were named as

defendants in a lawsuit filed in the United States District Court for the Southern District of Florida. The plaintiff

alleges violations of the Securities Exchange Act of 1934 and SEC Rule 10b-5, and seeks monetary damages,

including interest, and class action status on behalf of all plaintiffs who purchased the Company’s common stock

during the period between November 27, 2012 and January 29, 2014, inclusive. The claims focus primarily on

the Company’s statements concerning its financial condition and future business prospects for fiscal 2013 and the

first quarter of fiscal 2014, its stock repurchase program in 2012 and 2013 and the buyback of stock from Corvex

Management LP (“Corvex”) in November 2013. On June 27, 2014, another plaintiff filed a similar action in the

same court. On July 14, 2014, the Court entered an order consolidating the two actions under the caption

Henningsen v. The ADT Corporation, Case No. 14-80566-CIV-DIMITROULEAS, and appointing IBEW Local

595 Pension and Money Purchase Pension Plans, Macomb County Employees’ Retirement System and KBC

Asset Management NV as Lead Plaintiffs in the consolidated action. In addition to the Company, the defendants

named in the action are Naren Gursahaney, Kathryn A. Mikells, Michael S. Geltzeiler, Keith A. Meister and

Corvex. On September 25, 2014, defendants moved to dismiss this action. On November 13, 2014, Mr. Geltzeiler

was dismissed as a defendant without prejudice from this action. On June 4, 2015, the Court entered an order

granting the motions to dismiss and dismissed plaintiffs’ complaint in its entirety. The Court granted plaintiffs

leave to file an amended complaint on or before July 1, 2015. That deadline passed, and the Court dismissed the

action with prejudice on July 8, 2015. Plaintiffs filed a notice of appeal on August 7, 2015. On August 21, 2015,

defendants filed a motion to dismiss the appeal as untimely. The appeal and the motion to dismiss the appeal are

pending before the United States Court of Appeals for the Eleventh Circuit.

92