ADT 2015 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2015 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

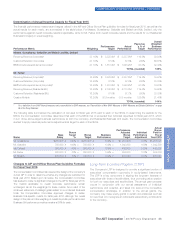

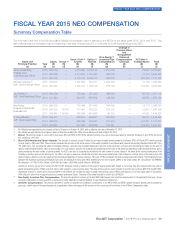

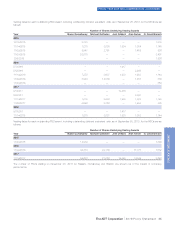

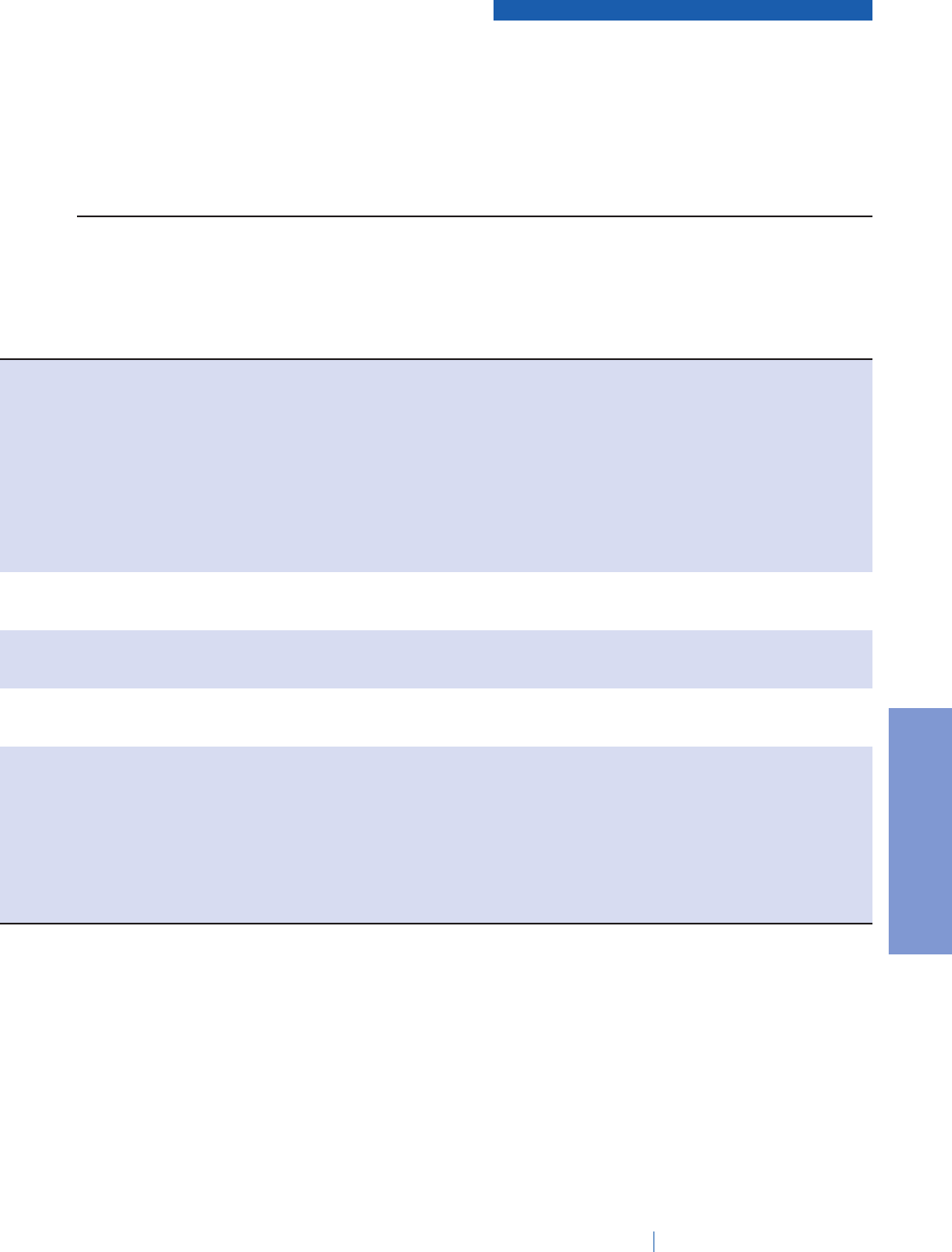

FISCAL YEAR 2015 NEO COMPENSATION—CONTINUED

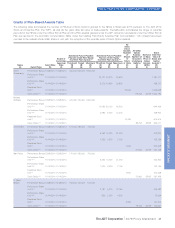

Outstanding Equity Awards at Fiscal Year-End Table

The following table shows outstanding Stock Option awards classified as exercisable and unexercisable and the number and value of any

unvested or unearned equity awards outstanding as of September 25, 2015 for each of the NEOs. The value of any unvested or unearned

equity awards outstanding is calculated based on a market value of $30.70, which was the NYSE closing price per share of the Company’s

common stock on September 25, 2015.

Option Awards (1) Stock Awards

Name

Number of

Securities

Underlying

Unexercised

Options: (#)

Exercisable

Number of

Securities

Underlying

Unexercised

Options: (#)

UnExercisable

Option

Exercise

Price

($)

Option

Expiration

Date

Number of

Shares or Units

of Stock That

Have Not Vested

(#) (2)

Market

Value of

Shares or

Units of

Stock

that Have

Not

Vested

($) (3)

Equity

Incentive Plan

Awards:

Number of

Unearned

Shares, Units

or Other Rights

That Have not

Vested

(#) (4)

Equity

Incentive Plan

Awards: Market

or Payout Value

of Unearned

Shares, Units or

Rights That

Have Not

Vested

($) (3)

Naren 14,741 — 31.1718 1/11/2016 83,686 2,569,160 99,012 3,039,668

Gursahaney 137,587 — 30.8309 11/20/2016

110,850 — 34.1771 7/2/2017

54,644 — 28.4959 8/17/2018

201,873 — 18.5745 10/6/2018

148,633 — 21.6169 9/30/2019

123,965 — 23.8843 10/11/2020

78,219 26,074 28.3870 10/11/2021

65,700 65,700 45.9000 11/29/2022

43,800 21,900 45.9000 11/29/2022

19,000 57,000 44.0100 11/21/2023

— 119,400 35.9800 11/13/2024

Michael 9,500 28,500 44.0100 11/21/2023 34,601 1,062,251 49,454 1,518,238

Geltzeiler 13,500 27,000 44.0100 11/21/2023

— 59,700 35.9800 11/13/2024

Jerri DeVard 16,600 33,200 31.3300 5/6/2024 23,402 718,441 14,549 446,654

4,350 13,050 31.3300 5/6/2024

— 31,800 35.9800 11/13/2024

Alan Ferber 19,350 19,350 44.4700 5/7/2023 18,003 552,692 26,319 807,993

5,050 15,150 44.0100 11/21/2023

— 31,800 35.9800 11/13/2024

N. David 10,515 — 30.8309 11/20/2016 16,021 491,845 15,730 482,911

Bleisch 11,491 — 34.1771 7/2/2017

14,410 — 18.5745 10/6/2018

10,523 — 21.6169 9/30/2019

20,468 — 23.8843 10/11/2020

13,559 4,520 28.3870 10/11/2021

6,200 3,100 45.9000 11/29/2022

7,500 7,500 45.9000 11/29/2022

3,025 9,075 44.0100 11/21/2023

— 19,100 35.9800 11/13/2024

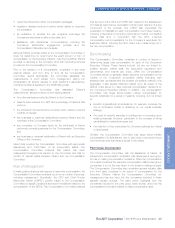

(1) Stock Options granted to the NEOs generally vest and become exercisable one-fourth per year on each anniversary of the grant date, with the exception of

certain one-time or sign-on grants. Stock Options granted to the NEOs expire on the day prior to the tenth anniversary of the grant date.

(2) The amounts shown in this column represent unvested awards of RSUs, including outstanding dividend equivalent units associated with the underlying RSU

awards. For Messrs. Gursahaney and Bleisch, also included are the earned portion of the PSU awards granted in fiscal year 2013, which at September 25,

2015 remain unvested. The three-year performance period for the fiscal year 2013 grant ended on September 25, 2015, the last day of fiscal year 2015. The

vesting period for the fiscal year 2013 grant, however, did not end until November 30, 2015, which was the third anniversary of the grant date.

(3) The amounts shown in these columns represent the market value of the unvested RSU and PSU awards calculated using a price of $30.70, which was the

closing price of the Company’s common stock on the NYSE on September 25, 2015.

(4) The amounts shown in this column represent outstanding and unvested awards of PSUs. The number of PSUs is based on the number granted (target

amount) and includes outstanding dividend equivalent units associated with the underlying award. Dividend equivalent units will vest only to the extent the

underlying awards vest based upon the Company’s performance against its performance targets. The three-year performance period for the fiscal year 2015

grant ends on September 30, 2017, the last day of fiscal year 2017. The three-year performance period for the fiscal year 2014 grant ends on September 30,

2016, the last day of fiscal year 2016.

The ADT Corporation 2016 Proxy Statement 43

PROXY STATEMENT