ADT 2015 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2015 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FORM 10-K

generated through our direct channel resulted from lead generation challenges partially due to the impact of the

competitive environment, the implementation of more stringent credit policies for new subscribers and increased

focus on ADT Pulse®upgrades for existing customers.

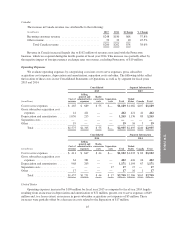

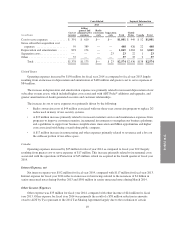

Ending number of customers, net of attrition, decreased by approximately 2.0% to 5.9 million for fiscal year

2014 as compared to 6.0 million for fiscal year 2013. This decrease was primarily due to the decline in gross

customers additions as discussed above. Customer unit attrition and customer revenue attrition as of

September 26, 2014 were 13.3% and 13.5%, respectively, compared with 13.3% and 13.8%, respectively, as of

September 27, 2013. Attrition was impacted favorably by several new programs implemented to address

voluntary, non-pay and relocation disconnects, offset by the impact of the competitive environment.

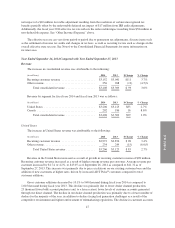

Canada

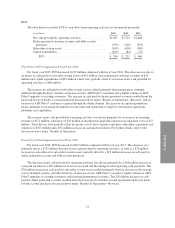

The increase in Canada revenue was attributable to the following:

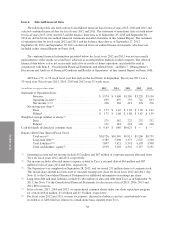

(in millions) 2014 2013 $ Change % Change

Recurring customer revenue .......................... $180 $167 $13 7.8%

Other revenue ...................................... 22 19 3 15.8%

Total Canada revenue ........................... $202 $186 $16 8.6%

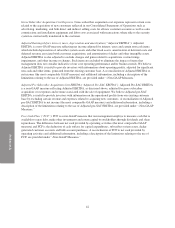

Revenue in Canada increased largely due to $33 million of revenue associated with the Protectron business,

which we acquired during the fourth quarter of fiscal year 2014. This increase was partially offset by the negative

impact of foreign currency exchange rates on revenue, excluding Protectron, of $11 million.

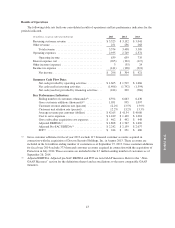

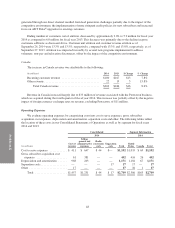

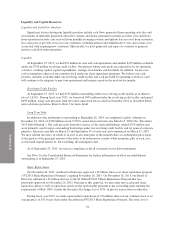

Operating Expenses

We evaluate operating expenses by categorizing costs into cost to serve expenses, gross subscriber

acquisition cost expenses, depreciation and amortization, separation costs and other. The following tables reflect

the location of these costs in our Consolidated Statements of Operations as well as by segment for fiscal years

2014 and 2013:

Consolidated Segment Information

2014 2014

(in millions)

Cost of

revenue

Selling,

general and

administrative

expenses

Radio

conversion

costs

Separation

costs Total

United

States Canada Total

Cost to serve expenses ............ $ 411 $ 647 $ 44 $— $1,102 $1,033 $ 69 $1,102

Gross subscriber acquisition cost

expenses ..................... 61 381 — — 442 416 26 442

Depreciation and amortization ...... 968 203 — — 1,171 1,104 67 1,171

Separation costs .................. — — — 17 17 17 — 17

Other .......................... 17 — — — 17 16 1 17

Total ...................... $1,457 $1,231 $ 44 $ 17 $2,749 $2,586 $163 $2,749

48