ADT 2015 Annual Report Download - page 149

Download and view the complete annual report

Please find page 149 of the 2015 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FORM 10-K

THE ADT CORPORATION

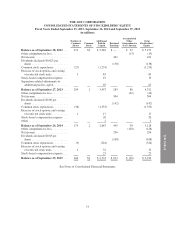

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

1. Basis of Presentation and Summary of Significant Accounting Policies

Nature of Business—The ADT Corporation (“ADT” or the “Company”), a company incorporated in the

state of Delaware, is a leading provider of monitored security, interactive home and business automation and

related monitoring services in the United States and Canada.

Basis of Presentation—The Consolidated Financial Statements include the accounts of the Company and its

wholly-owned subsidiaries and have been prepared in United States dollars (“USD”) in accordance with

generally accepted accounting principles in the United States of America (“GAAP”). Unless otherwise indicated,

references to 2015, 2014 and 2013 are to the Company’s fiscal years ended September 25, 2015, September 26,

2014 and September 27, 2013, respectively.

The Company has a 52- or 53-week fiscal year that ends on the last Friday in September. Fiscal years 2015,

2014 and 2013 were 52-week years. The Company’s next 53-week year will occur in fiscal year 2016.

Subsequent to September 25, 2015, the Company’s Board of Directors approved a change to the Company’s

fiscal year end from the last Friday in September to September 30 of each year. See Note 14 for further

information.

The Company conducts business through its operating entities. During the fourth quarter of fiscal year 2015,

the Company finalized its reporting structure following the acquisition of Reliance Protectron Inc. (“Protectron”),

which the Company acquired during the fourth quarter of fiscal year 2014. See Note 2 for details about this

acquisition. In connection with this reporting structure finalization, the manner in which the Chief Executive

Officer, who is the chief operating decision maker (“CODM”), evaluates performance and makes decisions about

how to allocate resources changed, resulting in the reorganization of the Company’s operating segment. The

Company now has two reportable segments, which are the Company’s operating segments, United States

(“U.S.”) and Canada. See Note 12 for further discussion on the Company’s segments.

All intercompany transactions have been eliminated. The results of companies acquired are included in the

Consolidated Financial Statements from the effective date of acquisition.

Use of Estimates—The preparation of the Consolidated Financial Statements in conformity with GAAP

requires management to make estimates and assumptions that affect the reported amount of assets and liabilities,

disclosure of contingent assets and liabilities and reported amounts of revenue and expenses. Significant

estimates in these Consolidated Financial Statements include, but are not limited to, estimates of future cash

flows and valuation related assumptions associated with asset impairment testing, useful lives and methods for

depreciation and amortization, loss contingencies, income taxes and tax valuation allowances and purchase price

allocations. Actual results could differ materially from these estimates.

Revenue Recognition—Substantially all of the Company’s revenue is generated by contractual monthly

recurring fees received for monitoring services provided to customers. Revenue from monitoring services is

recognized as those services are provided to customers. Customer billings for services not yet rendered are

deferred and recognized as revenue as the services are rendered. The balance of deferred revenue is included in

current liabilities or long-term liabilities, as appropriate.

For transactions in which the Company retains ownership of the security system, non-refundable fees

(referred to as deferred subscriber acquisition revenue) received in connection with the initiation of a monitoring

contract are deferred and amortized over the estimated life of the customer relationship. Transactions in which

the Company transfers ownership of the security system to the customer occur only in certain limited

circumstances.

75