ADT 2015 Annual Report Download - page 169

Download and view the complete annual report

Please find page 169 of the 2015 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FORM 10-K

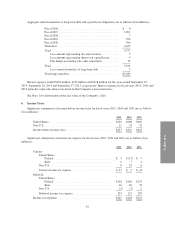

in conjunction with the Separation. The maximum amount of potential future payments is not determinable as

they relate to unknown conditions and future events that cannot be predicted.

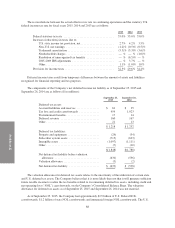

8. Retirement Plans

The Company measures its retirement plans as of its fiscal year end.

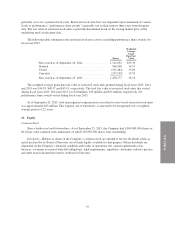

Defined Benefit Plans—The Company provides a defined benefit pension plan and certain other

postretirement benefits to certain employees. These plans were frozen prior to Separation and are not material to

the Company’s financial statements. As of September 25, 2015 and September 26, 2014, the fair values of

pension plan assets were $59 million and $62 million, respectively, and the fair values of projected benefit

obligations in aggregate were $87 million and $84 million, respectively. As a result, the plans were underfunded

by approximately $28 million and $22 million at September 25, 2015 and September 26, 2014, respectively, and

were recorded as a net liability in the Consolidated Balance Sheets. Net periodic benefit cost was not material for

fiscal years 2015, 2014 and 2013.

Defined Contribution Retirement Plans— The Company maintains several qualified defined contribution

plans, which include 401(k) matching programs in the U.S., as well as similar matching programs outside the

U.S. Expense for the defined contribution plans is computed as a percentage of participants’ compensation and

was $25 million, $20 million and $20 million for fiscal years 2015, 2014 and 2013, respectively.

Deferred Compensation Plan—The Company maintains a nonqualified Supplemental Savings and

Retirement Plan (“SSRP”), which permits eligible employees to defer a portion of their compensation. A record

keeping account is set up for each participant and the participant chooses from a variety of measurement funds

for the deemed investment of their accounts. The measurement funds correspond to a number of funds in the

Company’s 401(k) plan and the account balance fluctuates with the investment returns on those funds. Deferred

compensation liabilities were $17 million as of September 25, 2015 and September 26, 2014. Deferred

compensation expense was not material for fiscal years 2015, 2014 and 2013.

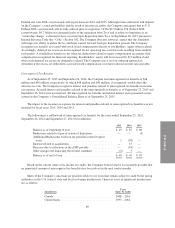

9. Share Plans

Stock Compensation Plans

Prior to the Separation, the Company adopted The ADT Corporation 2012 Stock Incentive Plan (the

“Plan”). The Plan provides for the award of stock options, stock appreciation rights, annual performance bonuses,

long-term performance awards, restricted units, restricted stock, deferred stock units, promissory stock and other

stock-based awards (collectively, “Awards”). In addition to the incentive equity awards converted from Tyco

awards, the Plan provides for a maximum of 8 million common shares to be issued as Awards, subject to

adjustment as provided under the terms of the Plan.

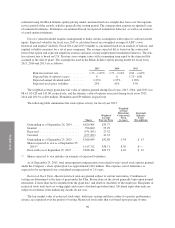

Stock-based compensation expense is included in selling, general and administrative expenses in the

Consolidated Statements of Operations. The stock-based compensation expense recognized and the associated

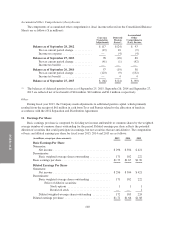

tax benefit for fiscal years 2015, 2014 and 2013 are as follows ($ in millions):

2015 2014 2013

Stock-based compensation expense recognized .................. $23 $20 $19

Tax benefit associated with stock-based compensation ............. 9 8 7

Stock Options—Options are granted to purchase common shares at prices that are equal to the fair market

value of the common shares on the date the option is granted. Conditions of vesting are determined at the time of

grant under the Plan. Options granted under the Plan generally vest in equal annual installments over a period of

four years and generally expire 10 years after the date of grant. The grant-date fair value of each option grant is

95