ADT 2015 Annual Report Download - page 156

Download and view the complete annual report

Please find page 156 of the 2015 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FORM 10-K

2. Acquisitions

Dealer Generated Customer Accounts and Bulk Account Purchases

During fiscal years 2015, 2014 and 2013, the Company paid $559 million, $526 million and $555 million,

respectively, for customer contracts for electronic security services generated under the ADT dealer program and

bulk account purchases.

Acquisitions

On July 8, 2014, the Company acquired all of the issued and outstanding capital stock of Protectron, a

leading electronic security services company in Canada. The primary purpose of the acquisition was to expand

the Company’s market share in Canada and create a stronger organization that is better positioned to serve

Canadian customers. The consideration transferred in Canadian dollars (“CAD”) was CAD $560 million ($525

million), and cash paid during fiscal year 2014 was $517 million, net of cash acquired. The transaction was

financed with borrowings of $375 million under the Company’s revolving credit facility and cash on hand.

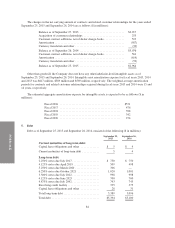

Under the acquisition method of accounting, the purchase price has been allocated to Protectron’s tangible

and identifiable intangible assets acquired and liabilities assumed based on estimates of fair value using available

information and making assumptions management believes are reasonable. The excess of the purchase price over

those fair values was recorded as goodwill. The following table summarizes the allocation of the purchase price

of this acquisition and the estimated fair value of the assets acquired and liabilities assumed at the date of

acquisition for fiscal year 2014:

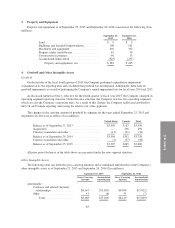

Estimated fair value of assets acquired and liabilities assumed

($ in millions):

Cash and cash equivalents ............................... $ 5

Customer relationships ................................. 253

Trade name and other intangibles ......................... 43

Goodwill ............................................ 296

Deferred tax liabilities .................................. (65)

Other, net ............................................ (7)

Consideration transferred ............................... $525

Adjustments made to the purchase price allocation for the Protectron acquisition during fiscal 2015 were not

material to the Consolidated Financial Statements. The amortization period for intangible assets acquired ranges

from 7 to 20 years. The Company recorded approximately $296 million of goodwill, reflecting the strategic fit

and the value of Protectron’s recurring revenue and earnings growth potential to the Company. The goodwill

amount was not deductible for tax purposes. Protectron’s impact on the Company’s Consolidated Results of

Operations for fiscal year 2014 and pro-forma results for fiscal years 2014 and 2013 was immaterial.

On August 2, 2013, the Company acquired all of the issued and outstanding capital stock of Devcon

Security Holdings, Inc. (“Devcon Security”) for cash consideration of $146 million, net of cash acquired. Devcon

Security provides alarm monitoring services and related equipment to residential homes, businesses and

homeowner associations in the United States. As part of this acquisition, the Company recognized intangible

assets of $84 million in customer relationships and $60 million of goodwill as well as insignificant amounts of

net working capital and tangible assets. On October 1, 2012, the Company completed its acquisition of Absolute

Security, which had been an ADT authorized dealer, with $16 million of cash paid during fiscal year 2013. As

part of this acquisition, the Company recognized $20 million of goodwill.

82