ADT 2015 Annual Report Download - page 175

Download and view the complete annual report

Please find page 175 of the 2015 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FORM 10-K

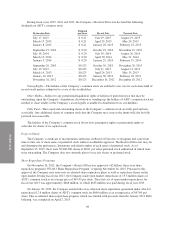

The computation of diluted earnings per share excludes potentially dilutive securities whose effect would

have been anti-dilutive in the amount of 2.3 million shares for fiscal year 2015, 1.7 million shares for fiscal year

2014 and 0.8 million shares for fiscal year 2013.

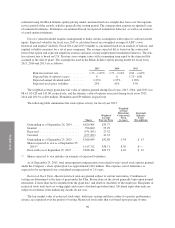

12. Segment Data

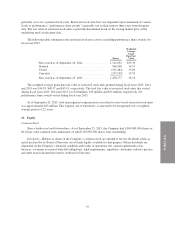

As discussed in Note 1, during the fourth quarter of fiscal year 2015, the manner in which the CODM

evaluates performance and makes decisions about how to allocate resources changed, resulting in the

reorganization of the Company’s operating segments. The Company now has two reportable segments, which are

the Company’s operating segments, United States and Canada. This change provides greater clarity and

transparency regarding the markets, financial performance and business model of the United States and Canada

businesses. All discussions and amounts reported below are based on the new segment structure.

The United States segment includes sales, installation and monitoring for residential, business, and health

customers in the United States and Puerto Rico, as well as corporate expenses and other operating costs

associated with support functions in the U.S.

The Canada segment includes sales, installation and monitoring for residential, business, and health

customers in Canada as well as operating expenses associated with certain support functions in Canada.

The accounting policies of the Company’s reportable segments are the same as those described in Note 1.

The Company’s CODM evaluates segment performance based on several factors, of which the primary

financial measures is on the basis of revenue and Adjusted EBITDA. Revenues are attributed to individual

countries based upon the operating entity that records the transaction. Adjusted EBITDA is defined as net income

adjusted for interest, taxes and certain non-cash items which include depreciation of subscriber system assets and

other fixed assets, amortization of deferred costs and deferred revenue associated with customer acquisitions, and

amortization of dealer and other intangible assets. Adjusted EBITDA is also adjusted to exclude charges and

gains related to acquisitions, restructurings, impairments, and other income or charges. Such items are excluded

to eliminate the impact of items that management does not consider indicative of the Company’s core operating

performance and/or business trends of the Company.

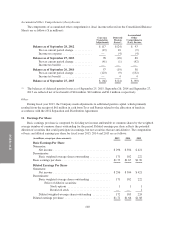

Segment results for the years ended September 25, 2015, September 26, 2014 and September 27, 2013 are

as follows ($ in millions):

2015 2014 2013

Revenue:

United States ...................................... $3,294 $3,206 $3,123

Canada ........................................... 280 202 186

Total ......................................... $3,574 $3,408 $3,309

2015 2014 2013

Adjusted EBITDA:

United States ...................................... $1,685 $1,671 $1,592

Canada ........................................... 123 96 98

Total ......................................... $1,808 $1,767 $1,690

2015 2014 2013

Depreciation and Amortization:

United States ...................................... $1,176 $1,104 $1,004

Canada ........................................... 89 67 61

Total ......................................... $1,265 $1,171 $1,065

101