ADT 2015 Annual Report Download - page 171

Download and view the complete annual report

Please find page 171 of the 2015 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FORM 10-K

generally vest over a period of four years. Restricted stock units that vest dependent upon attainment of various

levels of performance (“performance share awards”) generally vest in their entirety three years from the grant

date. The fair value of restricted stock units is generally determined based on the closing market price of the

underlying stock on the grant date.

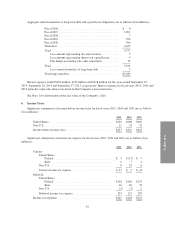

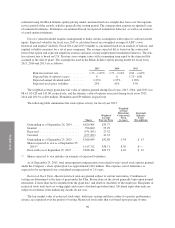

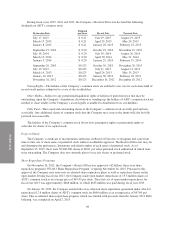

The following table summarizes the restricted stock unit activity, including performance share awards, for

fiscal year 2015:

Shares

Weighted-

Average

Grant-

Date Fair

Value

Non-vested as of September 26, 2014 ............... 1,112,692 $39.39

Granted ....................................... 766,508 34.53

Vested ........................................ (315,484) 33.00

Canceled ...................................... (133,539) 39.53

Non-vested as of September 25, 2015 ............... 1,430,177 38.16

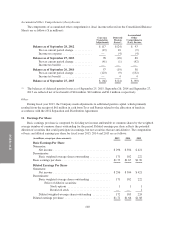

The weighted-average grant-date fair value of restricted stock units granted during fiscal years 2015, 2014

and 2013 was $34.53, $40.57 and $45.91, respectively. The total fair value of restricted stock units that vested

during fiscal years 2015, 2014 and 2013 was $10 million, $15 million and $32 million, respectively. No

performance share awards vested during fiscal year 2015.

As of September 25, 2015, total unrecognized compensation cost related to non-vested restricted stock units

was approximately $25 million. This expense, net of forfeitures, is expected to be recognized over a weighted-

average period of 2.2 years.

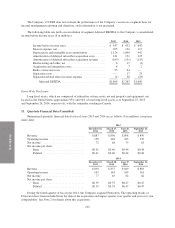

10. Equity

Common Stock

Shares Authorized and Outstanding—As of September 25, 2015, the Company had 1,000,000,000 shares of

$0.01 par value common stock authorized, of which 165,850,306 shares were outstanding.

Dividends—Holders of shares of the Company’s common stock are entitled to receive dividends when, as

and if declared by its Board of Directors out of funds legally available for that purpose. Future dividends are

dependent on the Company’s financial condition and results of operations, the capital requirements of its

business, covenants associated with debt obligations, legal requirements, regulatory constraints, industry practice

and other factors deemed relevant by its Board of Directors.

97