ADT 2015 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2015 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COMPENSATION OF EXECUTIVE OFFICERS—CONTINUED

sustainable long-term growth. Annual incentive compensation and

50% of target long-term equity incentive value is earned by the NEOs

only when the Company attains specified goals, thereby placing a

substantial portion of executive compensation at risk. The remaining

50% of executives’ target long-term equity incentive value is awarded

in Stock Options and time-vested Restricted Stock Units (“RSUs”),

the value of each of which is dependent on the Company’s stock

price performance.

Short-Term Incentives. We set aggressive targets in the annual

incentive plans for fiscal year 2015 that support both short- and long-

term success. In fiscal year 2015, the Company exceeded both

Recurring Revenue and Customer Retention targets in its Annual

Incentive Plan (“AIP”), while delivering EBITDA slightly below target

performance. Due to this overall above target performance, the CEO

was awarded an annual incentive equal to 139% of his targeted

award, and the other NEOs received an average payout of 140% of

their targeted awards, including the impact of each of their

performance against individual objectives.

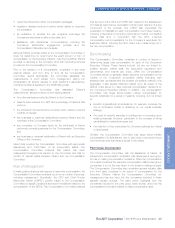

The chart below highlights the Company’s improving performance in

three key operating metrics (Recurring Revenue, Customer Retention

and EBITDA) over the past three fiscal years, as well as the annual

incentive compensation actually paid to the CEO over the same

period. We believe that these operating metrics have a strong

correlation with long-term value creation for our stockholders, and that

the associated improvement in these metrics is reflected in the annual

incentive compensation for the CEO.

FY2013

CEO Earned Annual

Incentive CompensationRecurring Revenue Customer Retention

EBITDA*

(before special items)

FY2014 FY2015FY2013 FY2014 FY2015 FY2013 FY2014 FY2015 FY2013 FY2014 FY2015

$1,400

$1,200

$1,000

$800

$600

$400

$200

$693

In Thousands

$630

$1,251

$0

$3,041

$3,152

$3,323

In Millions

$2,900

$2,950

$3,000

$3,050

$3,100

$3,150

$3,200

$3,250

$3,300

$3,350

% of Customers Retained (Units)

88.0%

87.8%

87.6%

87.4%

87.2%

87.0%

86.8%

86.6%

86.4%

86.2%

86.7% 86.8%

87.8%

86.0%

In Millions

$1,620

$1,640

$1,660

$1,680

$1,700

$1,720

$1,740

$1,760

$1,780

$1,800

$1,820

$1,690

$1,767

$1,808

* For a definition of non-GAAP financial measures and a reconciliation to GAAP measures, see “Reconciliation of Non-GAAP Measures to GAAP Measures and Selected Definitions” on

page 53 of this Proxy Statement.

Long-Term Incentives. The fiscal year 2015 long-term incentive

program was designed to reward management for performance

directly related to increasing stockholder value. The CEO and the

other Executive Officers received 50% of their target long-term

incentive value in the form of Performance Share Units (“PSUs”),

whose vesting is contingent upon achieving EBITDA and Total

Shareholder Return (“TSR”) goals over a three-year performance

period. An additional 25% of target long-term incentive value for the

CEO and other Executive Officers was delivered in the form of Stock

Options, which deliver value only when long-term stock price

appreciation is achieved. The remaining 25% of target long-term

incentive value was awarded in the form of RSUs, which deliver

higher value when there is long-term stock price appreciation.

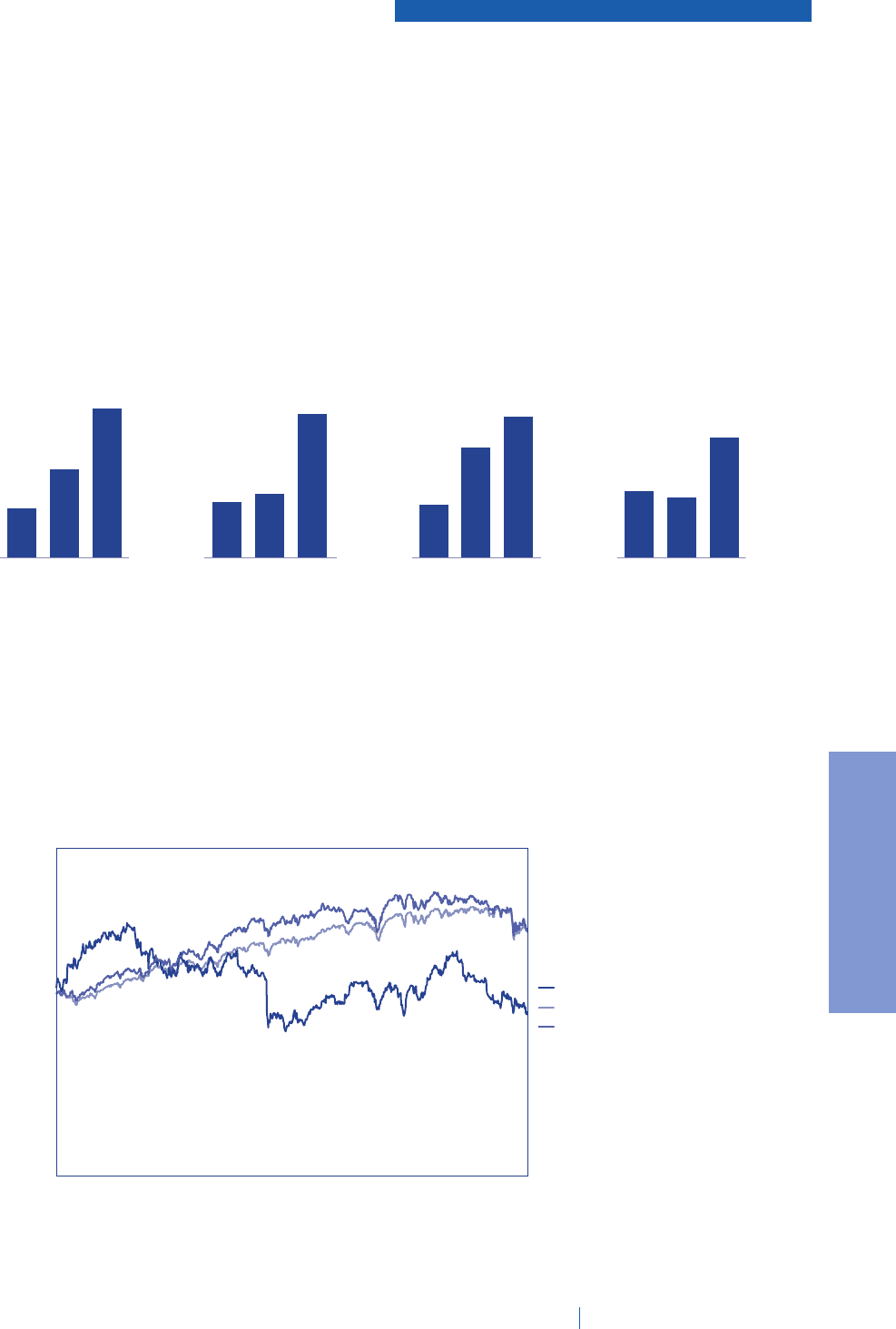

The following graph provides a comparison of the cumulative TSR on

the Company’s common stock to the returns of the Standard &

Poor’s (“S&P”) 500 Index and the S&P 500 Industrial Index from

October 1, 2012 (the first day of fiscal year 2013) through

September 25, 2015 (the last day of fiscal year 2015). From

inception through the end of fiscal year 2015, ADT’s TSR was -9.8%.

$160.00

$180.00

$140.00

$100.00

$120.00

$80.00

$40.00

$60.00

$20.00

$-

Oct-12 Apr-13 Oct-13 Apr-14 Oct-14 Apr-15 Sep-15

ADT

S&P500

S&P 500 Industrials (S5INDU)

The ADT Corporation 2016 Proxy Statement 27

PROXY STATEMENT