ADT 2015 Annual Report Download - page 174

Download and view the complete annual report

Please find page 174 of the 2015 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FORM 10-K

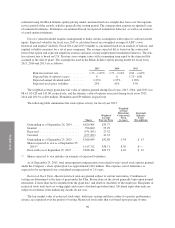

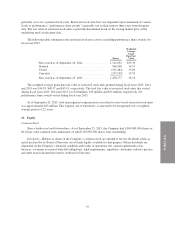

Accumulated Other Comprehensive (Loss) Income

The components of accumulated other comprehensive (loss) income reflected on the Consolidated Balance

Sheets are as follows ($ in millions):

Currency

Translation

Adjustments

Deferred

Pension

Losses(1)

Accumulated

Other

Comprehensive

(Loss) Income

Balance as of September 28, 2012 $ 117 $ (24) $ 93

Pre-tax current period change ............ (19) 10 (9)

Income tax expense .................... — (4) (4)

Balance as of September 27, 2013 98 (18) 80

Pre-tax current period change ............ (41) (1) (42)

Income tax benefit ..................... — — —

Balance as of September 26, 2014 57 (19) 38

Pre-tax current period change ............ (123) (9) (132)

Income tax benefit ..................... — 4 4

Balance as of September 25, 2015 $ (66) $ (24) $ (90)

(1) The balances of deferred pension losses as of September 25, 2015, September 26, 2014 and September 27,

2013 are reflected net of tax benefit of $16 million, $12 million and $11 million, respectively.

Other

During fiscal year 2013, the Company made adjustments to additional paid-in capital, which primarily

resulted from the receipt of $61 million in cash from Tyco and Pentair related to the allocation of funds in

accordance with the 2012 Separation and Distribution Agreement.

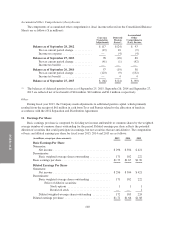

11. Earnings Per Share

Basic earnings per share is computed by dividing net income attributable to common shares by the weighted

average number of common shares outstanding for the period. Diluted earnings per share reflects the potential

dilution of securities that could participate in earnings, but not securities that are anti-dilutive. The computation

of basic and diluted earnings per share for fiscal years 2015, 2014 and 2013 are as follows:

(in millions, except per share amounts) 2015 2014 2013

Basic Earnings Per Share

Numerator:

Net income ....................................... $296 $304 $421

Denominator:

Basic weighted-average shares outstanding .............. 171 182 222

Basic earnings per share ................................. $1.73 $1.67 $1.90

Diluted Earnings Per Share

Numerator:

Net income ....................................... $296 $304 $421

Denominator:

Basic weighted-average shares outstanding .............. 171 182 222

Effect of dilutive securities:

Stock options .............................111

Restricted stock ........................... — — 1

Diluted weighted-average shares outstanding ............ 172 183 224

Diluted earnings per share ............................... $1.72 $1.66 $1.88

100