ADT 2015 Annual Report Download - page 170

Download and view the complete annual report

Please find page 170 of the 2015 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FORM 10-K

estimated using the Black-Scholes option pricing model and amortized on a straight-line basis over the requisite

service period of the awards, which is generally the vesting period. The compensation expense recognized is net

of estimated forfeitures. Forfeitures are estimated based on expected termination behavior, as well as an analysis

of actual option forfeitures.

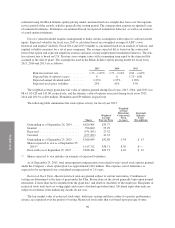

Use of a valuation model requires management to make certain assumptions with respect to selected model

inputs. Expected volatility for fiscal year 2015 is calculated based on a weighted average of ADT’s own

historical and implied volatility. Fiscal 2014 and 2013 volatility is calculated based on an analysis of historic and

implied volatility measures for a set of peer companies. The average expected life is based on the contractual

term of the option and expected employee exercise and post-vesting employment termination behavior. The risk-

free interest rate is based on U.S. Treasury zero-coupon issues with a remaining term equal to the expected life

assumed at the date of grant. The assumptions used in the Black-Scholes option pricing model for fiscal years

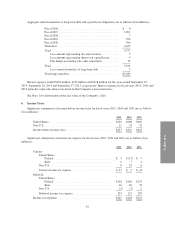

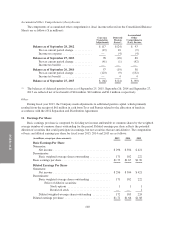

2015, 2014 and 2013 are as follows:

2015 2014 2013

Risk-free interest rate .................. 1.73 – 1.87% 1.73 – 2.10% 0.81 – 1.62%

Expected life of options (years) .......... 6 6 5.75 – 6.00

Expected annual dividend yield .......... 2.23% 1.95% 1.09%

Expected stock price volatility ........... 29% 41% 33%

The weighted-average grant-date fair value of options granted during fiscal years 2015, 2014, and 2013 was

$8.41, $14.20 and $13.06, respectively, and the intrinsic value of options exercised during fiscal years 2015,

2014 and 2013 was $10 million, $8 million and $59 million, respectively.

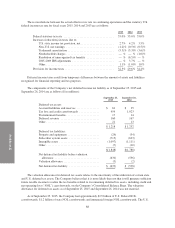

The following table summarizes the stock option activity for fiscal year 2015:

Shares

Weighted-

Average

Exercise Price

Weighted-

Average

Remaining

Contractual

Term

(in years)

Aggregate

Intrinsic

Value

($ in millions)

Outstanding as of September 26, 2014 .... 4,820,964 $31.77

Granted ............................ 796,660 35.99

Exercised ........................... (971,503) 27.52

Canceled ........................... (277,472) 41.33

Outstanding as of September 25, 2015 .... 4,368,649 $32.88 5.54 $ 13

Shares expected to vest as of September 25,

2015(1) ........................... 1,413,712 $38.71 8.30 $—

Exercisable as of September 25, 2015 ..... 2,828,424 $29.73 4.01 $ 12

(1) Shares expected to vest includes an estimate of expected forfeitures.

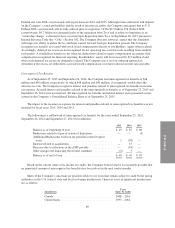

As of September 25, 2015, total unrecognized compensation cost related to non-vested stock options granted

under the Company’s share option plan was approximately $10 million. This expense, net of forfeitures, is

expected to be recognized over a weighted-average period of 2.4 years.

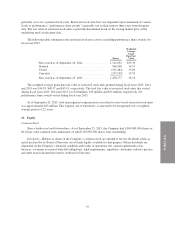

Restricted Stock Units—Restricted stock units are granted subject to certain restrictions. Conditions of

vesting are determined at the time of grant under the Plan. Restrictions on the award generally lapse upon normal

retirement, if more than twelve months from the grant date, and death or disability of the employee. Recipients of

restricted stock units have no voting rights and receive dividend equivalent units. Dividend equivalent units are

subject to forfeiture if the underlying awards do not vest.

The fair market value of restricted stock units, both time vesting and those subject to specific performance

criteria, are expensed over the period of vesting. Restricted stock units that vest based upon passage of time

96