ADT 2015 Annual Report Download - page 165

Download and view the complete annual report

Please find page 165 of the 2015 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FORM 10-K

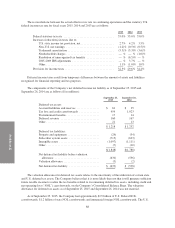

liabilities and required to make additional tax payments. Accordingly, under certain circumstances, ADT may be

obligated to pay amounts in excess of its agreed-upon share of its, Tyco’s and Pentair’s tax liabilities.

The Company recorded a receivable from Tyco for certain tax liabilities incurred by ADT but indemnified

by Tyco under the 2012 Tax Sharing Agreement. This receivable totaled $41 million as of September 27, 2013,

substantially all of which was released into other expense during fiscal year 2014. The actual amount that the

Company may be entitled to receive could vary depending upon the outcome of certain unresolved tax matters,

which may not be resolved for several years.

In conjunction with the Separation, substantially all of Tyco’s outstanding equity awards were converted

into like-kind awards of ADT, Tyco and Pentair. Pursuant to the terms of the 2012 Separation and Distribution

Agreement, each of the three companies is responsible for issuing its own shares upon employee exercises of

stock option awards or vesting of restricted stock units. However, the 2012 Tax Sharing Agreement provides that

any allowable compensation tax deduction for such awards is to be claimed by the employee’s current employer.

The 2012 Tax Sharing Agreement requires the employer claiming a tax deduction for shares issued by the other

companies to pay a percentage of the allowable tax deduction to the company issuing the equity. During the year

ended September 25, 2015, amounts recorded in connection with this arrangement were immaterial.

7. Commitments and Contingencies

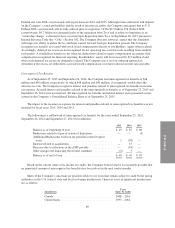

Lease Obligations

The Company has facility, vehicle and equipment leases that expire at various dates through fiscal year

2026. Rental expense under these leases was $56 million, $58 million and $50 million for fiscal years 2015, 2014

and 2013, respectively. Sublease income was immaterial for all years presented. In addition to operating leases,

the Company has commitments under capital leases for certain facilities, which are not material to the

Company’s Consolidated Financial Statements.

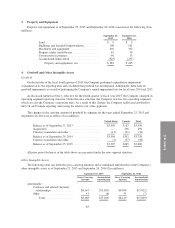

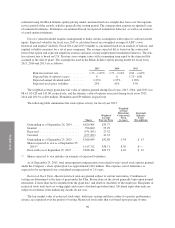

The following table provides a schedule of minimum lease payments for non-cancelable operating leases as

of September 25, 2015 ($ in millions):

Fiscal 2016 .......................................... $ 58

Fiscal 2017 .......................................... 52

Fiscal 2018 .......................................... 45

Fiscal 2019 .......................................... 35

Fiscal 2020 .......................................... 28

Thereafter ........................................... 46

264

Less sublease income .................................. 20

Total ............................................... $244

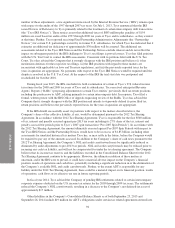

Purchase Obligations

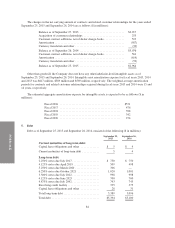

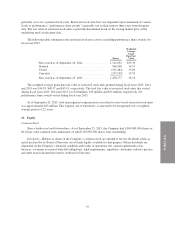

The following table provides a schedule of commitments related to agreements to purchase certain goods

and services, including purchase orders, entered into in the ordinary course of business, as of September 25, 2015

($ in millions):

Fiscal 2016 .......................................... $273

Fiscal 2017 .......................................... 182

Fiscal 2018 .......................................... 46

Fiscal 2019 .......................................... 1

Fiscal 2020 .......................................... —

Thereafter ........................................... —

Total ............................................... $502

91