ADT 2015 Annual Report Download - page 176

Download and view the complete annual report

Please find page 176 of the 2015 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FORM 10-K

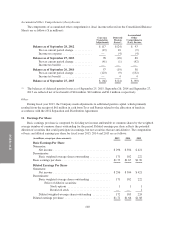

The Company’s CODM does not evaluate the performance of the Company’s assets on a segment basis for

internal management reporting and, therefore, such information is not presented.

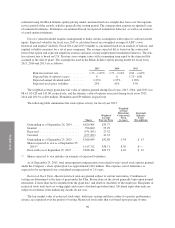

The following table sets forth a reconciliation of segment Adjusted EBITDA to the Company’s consolidated

income before income taxes ($ in millions):

2015 2014 2013

Income before income taxes ........................... $ 437 $ 432 $ 642

Interest expense, net ................................. 205 192 117

Depreciation and intangible asset amortization ............ 1,124 1,040 942

Amortization of deferred subscriber acquisition costs ....... 141 131 123

Amortization of deferred subscriber acquisition revenue .... (163) (151) (135)

Restructuring and other, net ........................... 6 17 (1)

Acquisition and integration costs .......................472

Radio conversion costs ............................... 55 44 —

Separation costs .................................... — 17 23

Separation related other (income) expense ............... (1) 38 (23)

Adjusted EBITDA .............................. $1,808 $1,767 $1,690

Entity-Wide Disclosure

Long-lived assets, which are comprised of subscriber system assets, net and property and equipment, net,

located in the United States approximate 95% and 94% of total long-lived assets as of September 25, 2015

and September 26, 2014, respectively, with the remainder residing in Canada.

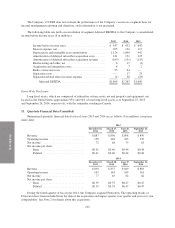

13. Quarterly Financial Data (Unaudited)

Summarized quarterly financial data for fiscal years 2015 and 2014 are as follows ($ in millions, except per

share data):

2015

December 26,

2014

March 27,

2015

June 26,

2015

September 25,

2015

Revenue ................................ $887 $890 $898 $899

Operating income ........................ 158 148 163 170

Net income .............................. 72 68 75 81

Net income per share:

Basic .............................. $0.41 $0.40 $0.44 $0.48

Diluted ............................. $0.41 $0.40 $0.44 $0.48

2014

December 27,

2013

March 28,

2014

June 27,

2014

September 26,

2014

Revenue ................................ $839 $837 $849 $883

Operating income ........................ 165 164 169 161

Net income .............................. 77 63 82 82

Net income per share:

Basic .............................. $0.39 $0.35 $0.47 $0.47

Diluted ............................. $0.39 $0.34 $0.47 $0.47

During the fourth quarter of fiscal year 2014, the Company acquired Protectron. The operating results of

Protectron have been included from the date of the acquisition and impact quarter over quarter and year over year

comparability. See Note 2 for details about this acquisition.

102