ADT 2007 Annual Report Download - page 84

Download and view the complete annual report

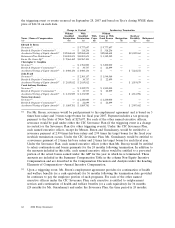

Please find page 84 of the 2007 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Code, including the value of any acceleration of unvested equity of Tyco Electronics and Covidien.

No other named executive officer is eligible for this benefit.

For Mr. Breen, termination benefits are governed by his employment agreement. For each of the

other named executive officers, the CIC Severance Plan governs for change in control triggering events

and the Severance Plan governs all other triggering events. In all cases, a ‘‘Qualified Termination’’

means a termination following a change in control that would provide the executive with a ‘‘Good

Reason’’ to terminate his employment, as defined under the CIC Severance Plan or under the

employment agreement (for Mr. Breen). For the definition of ‘‘Good Reason’’ and ‘‘Cause’’ under the

relevant documents, see the discussion under the heading Change in Control and Severance Benefits in

the Compensation Discussion and Analysis. Under Mr. Breen’s employment agreement, Mr. Breen

could terminate his employment for ‘‘Good Reason’’ by voluntarily resigning within the 30-day period

following the first anniversary of a change in control, in which case he would be entitled to severance

and the benefit and perquisite continuation described in column (c).

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934 requires Tyco’s officers and Directors and

persons who beneficially own more than ten percent of Tyco’s common shares to file reports of

ownership and changes in ownership of such common shares with the SEC and NYSE. These persons

are required by SEC regulations to furnish Tyco with copies of all Section 16(a) forms they file. As a

matter of practice, Tyco’s administrative staff assists Tyco’s officers and Directors in preparing initial

reports of ownership and reports of changes in ownership and files those reports on their behalf. Based

on Tyco’s review of the copies of such forms it has received, as well as information provided and

representations made by the reporting persons, Tyco believes that all of its officers, Directors and

beneficial owners of more than ten percent of its common shares complied with Section 16(a) during

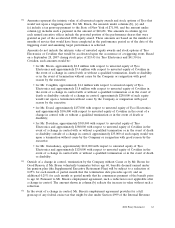

Tyco’s fiscal year ended September 28, 2007, except for two errors in calculation: a miscalculation of

Ms. Reinsdorf’s May 10, 2007 stock option grant, as reported on the Form 4 filed on May 11, 2007 and

a miscalculation of Mr. Breen’s Deferred Stock Unit holdings subsequent to the Separation, as

reported on the Form 4 filed on July 3, 2007. Amended Form 4s were filed on May 15, 2007 and

July 16, 2007 respectively.

AUDIT COMMITTEE REPORT

The Audit Committee of the Board is composed of four Directors, each of whom the Board has

determined meets the independence and experience requirements of the NYSE and the SEC. The

Audit Committee operates under a charter approved by the Board, which is posted on our website. As

more fully described in its charter, the Audit Committee oversees Tyco’s financial reporting process on

behalf of the Board. Management has the primary responsibility for the financial statements and the

reporting process, assures that the Company develops and maintains adequate financial controls and

procedures, and monitors compliance with these processes. Tyco’s independent auditors are responsible

for performing an audit in accordance with auditing standards generally accepted in the United States

to obtain reasonable assurance that Tyco’s consolidated financial statements are free from material

misstatement and expressing an opinion on the conformity of the financial statements with accounting

principles generally accepted in the United States. The internal auditors are responsible to the Audit

Committee and the Board for testing the integrity of the financial accounting and reporting control

systems and such other matters as the Audit Committee and Board determine.

In this context, the Audit Committee has reviewed the consolidated financial statements for the

fiscal year ended September 28, 2007, and has met and held discussions with management, the internal

auditors and the independent auditors concerning the consolidated financial statements, as well as the

report of management and the independent auditor’s opinion thereon regarding the Company’s internal

control over financial reporting required by Section 404 of the Sarbanes-Oxley Act of 2002.

64 2008 Proxy Statement