ADT 2007 Annual Report Download - page 166

Download and view the complete annual report

Please find page 166 of the 2007 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

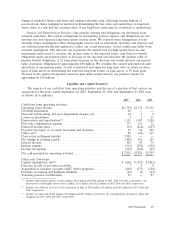

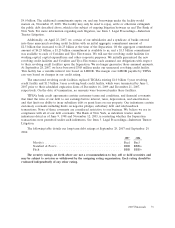

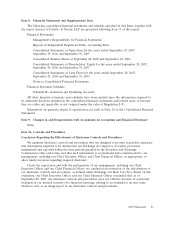

Commitments and Contingencies

Contractual Obligations

Contractual obligations and commitments for principal debt, minimum lease payment obligations

under non-cancelable operating leases and other obligations at September 28, 2007 is as follows ($ in

millions):

2008 2009 2010 2011 2012 Thereafter Total

Debt(1)(2) ........................... $372 $517 $ 1 $517 $1,158 $1,848 $4,413

Capital leases(1) ......................8764 2 37 64

Operating leases ..................... 291 226 171 123 72 157 1,040

Purchase obligations(3) ................. 114 7 3 — — — 124

Total contractual cash obligations(4) ........ $785 $757 $181 $644 $1,232 $2,042 $5,641

(1) Excludes interest.

(2) Excludes debt discount and swap activity.

(3) Purchase obligations consist of commitments for purchases of good and services.

(4) Other long-term liabilities primarily consist of the following: pension and postretirement costs, income taxes, warranty and

environmental liabilities and are excluded from this table. We are unable to estimate the timing of payment for these items

due to the inherent uncertainties of obligations of this type. The minimum required contributions to our pension plans are

expected to be approximately $69 million in 2008 and we expect to pay $7 million in 2008 related to postretirement benefit

plans.

At September 28, 2007, TIFSA had unsecured credit facilities of $1.25 billion due April 25, 2012,

of which approximately $0.9 billion was undrawn and available (see Note 13 to the Consolidated

Financial Statements). In addition, certain of the Company’s operating subsidiaries have uncommitted

overdraft and similar types of facilities, which total $55 million, of which $51 million was undrawn and

available. These facilities expire at various dates through the year 2009, most of which are renewable

and are established primarily within our international operations.

On June 21, 2007, Tyco and TIFSA entered into a new $500 million letter of credit facility, with

Citibank N.A. as administrative agent, expiring on December 15, 2007. The facility provides for the

issuance of letters of credit, supported by a related line of credit facility. TIFSA may only borrow under

the line of credit agreement to reimburse the bank for obligations with respect to letters of credit

issued under this facility. The covenants under this facility are substantially similar to the covenants

under the bridge loan and revolving credit facilities. TIFSA would pay interest on any outstanding

borrowings at a variable interest rate, based on the bank’s base rate or the Eurodollar rate, as defined.

As of September 28, 2007, letters of credit of $494 million have been issued under the $500 million

credit facility and $6 million remains available for issuance. There were no amounts borrowed under

this credit facility at September 28, 2007. On October 19, 2007, the facility was amended. The

amendment extended the maturity date to June 15, 2008 and adjusted the interest rate spreads and fees

applicable to extensions of credit thereunder. Loans under the amended letter of credit agreement will

continue to bear interest based on LIBOR plus the applicable margin.

At September 28, 2007, the Company had total outstanding letters of credit and bank guarantees

of $1.1 billion.

In the normal course of business, the Company is liable for contract completion and product

performance. In the opinion of management, such obligations will not significantly affect the

Company’s financial position, results of operations or cash flows.

In connection with the Separation, the Company entered into a liability sharing agreement

regarding certain class actions that were pending against Tyco prior to the Separation. Subject to the

74 2007 Financials