ADT 2007 Annual Report Download - page 203

Download and view the complete annual report

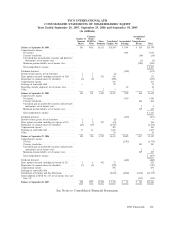

Please find page 203 of the 2007 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.TYCO INTERNATIONAL LTD.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

1. Basis of Presentation and Summary of Significant Accounting Policies (Continued)

date, management does not expect the adoption to have a material effect on the results of its

operations, financial position or cash flows.

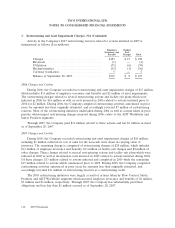

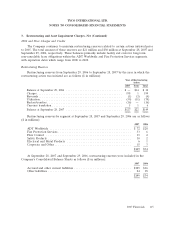

2. Discontinued Operations and Divestitures

Discontinued Operations

During the third quarter of 2007, Tyco completed the Separation and has presented its Healthcare

and Electronics businesses as discontinued operations in all periods presented.

In each period prior to the Separation, net interest and loss on early extinguishment of debt, which

is included in other expense, net in the Consolidated Statements of Operations, amounts were

proportionally allocated to Covidien and Tyco Electronics based on the debt amounts that Tyco believes

were utilized by Covidien and Tyco Electronics historically inclusive of amounts directly incurred.

Allocated net interest was calculated using our historical weighted-average interest rate on debt

including the impact of interest rate swap agreements. These allocated amounts were included in

discontinued operations. During 2007, allocated interest income, interest expense and other expense,

net was $35 million, $242 million and $388 million, respectively. During 2006, allocated interest income,

interest expense and other expense, net was $53 million, $378 million and $0 million, respectively.

During 2005, allocated interest income, interest expense and other expense, net was $43 million,

$433 million and $608 million, respectively.

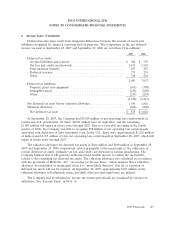

The Company has used available information to develop its best estimates for certain assets and

liabilities related to the Separation. In limited instances, final determination of the balances will be

made in subsequent periods. During the fourth quarter of 2007, $72 million was recorded through

shareholders’ equity, primarily related to the cash true-up adjustment and other items, as specified in

the Separation and Distribution Agreement, adjustments to certain pre-Separation tax liabilities, and

the impact of filing final income tax returns in certain jurisdictions where those returns include a

combination of Tyco, Covidien and/or Tyco Electronics legal entities. Additional adjustments are not

expected to be material and will be recorded through shareholder’s equity in subsequent periods as tax

returns are finalized.

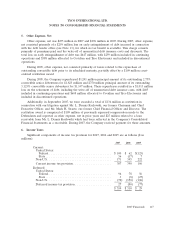

During 2007, AIJ, a joint venture that was majority owned by Infrastructure Services, was sold for

$42 million in net cash proceeds and a pre-tax gain on sale of $19 million was recorded. Additionally,

during the fourth quarter of 2007, the remaining portion of Infrastructure Services met the held for

sale criteria and its results of operations have been included in discontinued operations for all periods

presented. Infrastructure Services provides consulting, engineering, construction management and

operating services for the water, wastewater, environmental, transportation and facilities market. The

Company has assessed the recoverability of these businesses carrying values and will continue to assess

recoverability based on current fair value, less cost to sell, until the businesses are sold. On

September 17, 2007, the Company executed a definitive agreement to sell for approximately

$295 million in cash 100% of the stock of ETEO—Empresa de Transmissao de Energia do Oeste Ltda.,

a Brazilian subsidiary of Infrastructure Services. The transaction is subject to Brazilian regulatory

approval and normal closing conditions and is expected to close by the end of the second quarter of

fiscal 2008. The Company expects to sell the remaining portion of Infrastructure Services by the end of

fiscal 2008.

The AIJ, Infrastructure Services, Plastics, Adhesives and Ludlow Coated Products and A&E

Products businesses met the held for sale and discontinued operations criteria and have been included

in discontinued operations in all periods presented.

2007 Financials 111