ADT 2007 Annual Report Download - page 244

Download and view the complete annual report

Please find page 244 of the 2007 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.TYCO INTERNATIONAL LTD.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

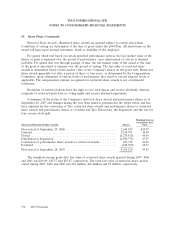

17. Retirement Plans (Continued)

In December 2003, the US enacted into law the Medicare Prescription Drug, Improvement and

Modernization Act of 2003 (the ‘‘Act’’). The Act introduces a prescription drug benefit under Medicare

(Medicare Part D), as well as a federal subsidy to sponsors of retiree health care benefit plans that

provide a benefit that is at least actuarially equivalent to Medicare Part D. Certain of the Company’s

retiree medical programs already provided prescription drug coverage for retirees over age 65 that were

at least as generous as the benefits provided under Medicare. This Act reduces the Company’s

obligation in these instances. The Company included the effects of the Act in the Consolidated

Financial Statements by reducing net periodic benefit cost by $5 million for 2005, and reflecting an

actuarial gain which reduced its accumulated postretirement benefit obligation by approximately

$30 million at September 30, 2005.

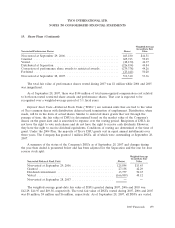

18. Shareholders’ Equity

Preference Shares—Tyco has authorized 31,250,000 preference shares, par value of $4 per share,

none of which were issued and outstanding at September 28, 2007 and September 29, 2006. Rights as

to dividends, return of capital, redemption, conversion, voting and otherwise with respect to the

preference shares may be determined by Tyco’s Board of Directors on or before the time of issuance.

In the event of the liquidation of the Company, the holders of any preference shares then outstanding

would be entitled to payment to them of the amount for which the preference shares were subscribed

and any unpaid dividends prior to any payment to the common shareholders.

Dividends—On September 13, 2007 Tyco’s Board of Directors approved a quarterly dividend on the

Company’s common shares of $0.15 per share payable on November 1, 2007 to shareholders of record

of Tyco International Ltd. post Separation on October 1, 2007. Tyco paid a quarterly cash dividend of

$0.05 in the first quarter of 2005 and $0.40 thereafter.

Shares Owned by Subsidiaries—Shares owned by subsidiaries are treated as treasury shares and are

recorded at cost. In connection with the Separation, all such shares were effectively retired during the

third quarter of 2007 and repurchases commenced in the fourth quarter of 2007.

Share Repurchase Program—In September 2007, Tyco’s Board of Directors approved a $1.0 billion

share repurchase program. In July 2005 and May 2006, Tyco’s Board of Directors approved share

repurchase programs of $1.5 billion and $2.0 billion, respectively. During the fourth quarter of 2007,

the Company repurchased 1.3 million common shares for $56 million under the $1.0 billion share

repurchase program. During the first quarter of 2007, the Company repurchased 5 million common

shares for $659 million completing the $2.0 billion share repurchase program. During 2006, the

Company repurchased 11 million common shares for $1.2 billion completing the $1.5 billion share

repurchase program and 13 million common shares for $1.3 billion under the $2.0 billion share

repurchase program. During 2005, the Company repurchased 3 million common shares for

$300 million.

19. Share Plans

In connection with the Separation, share options were modified through the issuance of Covidien

and Tyco Electronics share options. As a result of the one for four share split, share option exercise

152 2007 Financials