ADT 2007 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2007 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274

|

|

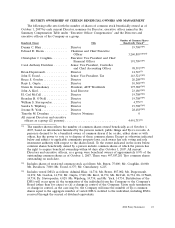

(4) Includes the maximum number of shares for which these individuals can acquire beneficial

ownership upon the exercise of stock options that are currently vested or will vest before

November 30, 2007 as follows: Admiral Blair, 4,974; Mr. Breen, 2,259,891; Mr. Coughlin, 146,709;

Mr. Davidson, 88,206; Mr. Evard, 135,468; Mr. Gordon, 4,974; Mr. Gursahaney, 185,692; Mr. Krol,

5,996; Mr. McCall, 4,974; Dr. O’Neill, 4,974; Ms. Wijnberg, 4.974; and Mr. York, 4,974.

(5) Includes 1,000 shares owned by Mr. Gupta’s spouse.

(6) Includes 2,400 shares held indirectly as to which voting and/or investment power is shared with or

controlled by another person and as to which voting beneficial ownership is not disclaimed.

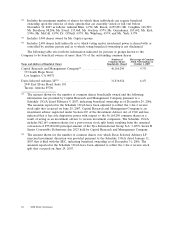

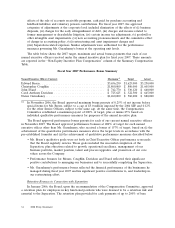

The following table sets forth the information indicated for persons or groups known to the

Company to be beneficial owners of more than 5% of the outstanding common shares.

Number of Percentage of Common

Common Shares Stock Outstanding on

Name and Address of Beneficial Owner Beneficially Owned October 1, 2007

Capital Research and Management Company(1) ............ 46,164,290 9.3%

333 South Hope Street

Los Angeles, CA 90071

Davis Selected Advisers LP(2) ......................... 31,836,924 6.4%

2949 East Elvira Road, Suite 101

Tucson, Arizona 85706

(1) The amount shown for the number of common shares beneficially owned and the following

information was provided by Capital Research and Management Company pursuant to a

Schedule 13G/A dated February 9, 2007, indicating beneficial ownership as of December 29, 2006.

The amounts reported in the Schedule 13G/A have been adjusted to reflect the 1-for-4 reverse

stock split that occurred on June 29, 2007. Capital Research and Management Company is an

investment advisor registered under Section 203 of the Investment Advisor Act of 1940 and has

indicated that it has sole dispositive power with respect to the 46,164,290 common shares as a

result of acting as an investment advisor to various investment companies. The Schedule 13G/A

includes 862,165 common shares (on a post-reverse stock split basis) resulting from the assumed

conversion of $75,000,000 principal amount of the Tyco International Group S.A. 3.125% Series B

Senior Convertible Debentures due 2023 held by Capital Research and Management Company.

(2) The amount shown for the number of common shares over which Davis Selected Advisers LP

exercised investment discretion was provided pursuant to the Schedule 13G/A dated January 11,

2007 that it filed with the SEC, indicating beneficial ownership as of December 31, 2006. The

amounts reported in the Schedule 13G/A have been adjusted to reflect the 1-for-4 reverse stock

split that occurred on June 29, 2007.

24 2008 Proxy Statement