ADT 2007 Annual Report Download - page 165

Download and view the complete annual report

Please find page 165 of the 2007 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274

|

|

$4.0 billion. The additional commitments expire on, and any borrowings under the facility would

mature on, November 25, 2008. The facility may only be used to repay, settle or otherwise extinguish

the public debt described above, which is the subject of ongoing litigation between us and The Bank of

New York. For more information regarding such litigation, see Item 3. Legal Proceedings—Indenture

Trustee Litigation.

Additionally, on April 25, 2007, we, certain of our subsidiaries and a syndicate of banks entered

into three unsecured revolving credit facilities with an initial aggregate commitment amount of

$2.5 billion that increased to $4.25 billion at the time of the Separation. Of the aggregate commitment

amount of $4.25 billion, a $1.25 billion commitment is available to us, and a $1.5 billion commitment

was available to each of Covidien and Tyco Electronics. We will use the revolving credit facilities for

working capital, capital expenditures and other corporate purposes. We initially guaranteed the new

revolving credit facilities and Covidien and Tyco Electronics each assumed our obligations with respect

to their revolving credit facilities upon the Separation. We no longer guarantee those assumed amounts.

At September 28, 2007, we have borrowed $308 million under our unsecured revolving credit facility.

This facility has a variable interest rate based on LIBOR. The margin over LIBOR payable by TIFSA

can vary based on changes in our credit rating.

The unsecured revolving credit facilities replaced TIGSA’s existing $1.0 billion 5-year revolving

credit facility and $1.5 billion 3-year revolving bank credit facility, which were terminated by June 1,

2007 prior to their scheduled expiration dates of December 16, 2009 and December 21, 2007,

respectively. On the date of termination, no amounts were borrowed under these facilities.

TIFSA’s bank credit agreements contain customary terms and conditions, and financial covenants

that limit the ratio of our debt to our earnings before interest, taxes, depreciation, and amortization

and that limit our ability to incur subsidiary debt or grant liens on our property. Our indentures contain

customary covenants including limits on negative pledges, subsidiary debt and sale/leaseback

transactions. None of these covenants are considered restrictive to our business. We believe we are in

compliance with all of our debt covenants. The Bank of New York, as indenture trustee under

indentures dated as of June 9, 1998 and November 12, 2003, is contesting whether the Separation

transactions were permitted under such indentures. See Item 3. Legal Proceedings—Indenture Trustee

Litigation.

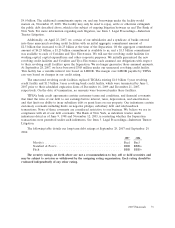

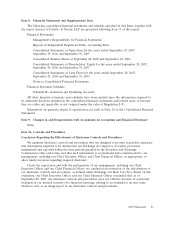

The following table details our long-term debt ratings at September 28, 2007 and September 29,

2006:

2007 2006

Moody’s ............................................ Baa1 Baa3

Standard & Poor’s ..................................... BBB BBB+

Fitch .............................................. BBB BBB+

The security ratings set forth above are not a recommendation to buy, sell or hold securities and

may be subject to revision or withdrawal by the assigning rating organization. Each rating should be

evaluated independently of any other rating.

2007 Financials 73