ADT 2007 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2007 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.reductions resulting from the Separation and our restructuring activities. Both Mr. Lytton’s and

Mr. Robinson’s severance benefits are described in detail in the Summary Compensation Table and the

other tables in the Executive Compensation Tables that follow this Compensation Discussion and

Analysis.

Pay Recoupment Policy

Tyco has a successful track record in recouping pay we consider wrongfully earned by executives.

To demonstrate our full commitment to shareholders on this issue, the Board approved a Pay

Recoupment Policy for Tyco in September 2007. The policy provides that:

In addition to any other remedies available to the Company and subject to the applicable law, if the

Board or any Compensation Committee of the Board determines that any Annual Incentive Plan (‘‘AIP’’)

payment, incentive payment, equity award or other compensation received by a Senior Officer resulted from

any financial result or operating metric that was impacted by the Senior Officer’s fraudulent or illegal

conduct, the Board or a Board Committee may recover from the Senior Officer that compensation it

considers appropriate under the circumstances. The Board has the sole discretion to make any and all

determinations under this policy.

Stock Ownership Guidelines

In 2003, the Board established stock ownership and share retention guidelines for all Senior

Officers. The Board believes that executives who own a significant amount of Company stock are

aligned with long-term shareholder interests. Currently, 10 Senior Officers, including our five current

named executive officers, are covered by the stock ownership and retention guidelines. The

Compensation Committee reviews our Senior Officers’ compliance with our stock ownership guidelines

throughout the year.

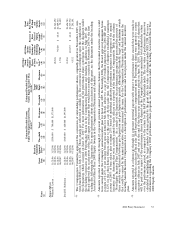

The stock ownership requirement for our Senior Officers ranges from two times base salary for

our corporate Senior Vice Presidents to ten times base salary for our Chief Executive Officer. Tyco

shares that count towards meeting the stock ownership requirement include restricted stock, RSUs,

deferred stock units, performance shares, shares acquired through our 401(k) plan or the Employee

Stock Purchase Program, and shares otherwise owned by the executive. We do not require that the

stock ownership guidelines be attained within a certain period of time. Instead, the Compensation

Committee reviews executive stock ownership throughout the year to ensure that our Senior Officers

are making progress towards meeting their goals or maintaining their requisite ownership. During the

2006 fiscal year, the Compensation Committee reviewed the Stock Ownership and Retention Guidelines

(the ‘‘Guidelines’’) and determined that ownership levels were appropriate, even though they were

significantly higher for certain positions than the levels prevailing at peer companies.

Tyco’s stock retention Guidelines require that our Senior officers retain a specified percentage of

net (after-tax) shares acquired from the exercise of stock options or the vesting of restricted shares.

Specifically, our Senior Officers must retain 75% of all net shares until they attain their target stock

ownership goal. Once that goal is attained, they must retain at least 25% of all net shares received

upon exercise or vesting for a minimum period of three years. Senior Officers who are 62 or older may

dispose of 50% of their accumulated holdings.

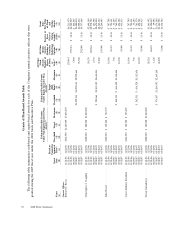

Prior to the Separation, all of the named executive officers attained or exceeded their target stock

ownership requirement. In connection with the Separation, restricted shares, performance shares and

stock options granted prior to the start of fiscal year 2007 owned by certain Tyco employees were

converted into shares of Covidien and Tyco Electronics. Tyco recertified stock ownership for our named

executive officers using their post-conversion share balances and Tyco’s average stock price for the

60 days following the measurement date, which covered the period from July 2, 2007 to August 31,

2007. For purposes of this analysis, the certification date was August 31, 2007. Following Separation, we

determined that all of the named executive officers remained in compliance with the stock ownership

guidelines. The following table shows the target stock ownership Guideline, each named executive

2008 Proxy Statement 47