ADT 2007 Annual Report Download - page 195

Download and view the complete annual report

Please find page 195 of the 2007 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.TYCO INTERNATIONAL LTD.

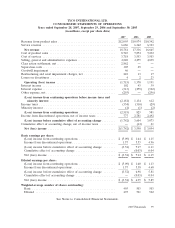

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

1. Basis of Presentation and Summary of Significant Accounting Policies

Basis of Presentation—The Consolidated Financial Statements include the consolidated accounts of

Tyco International Ltd., a company organized under the laws of Bermuda, and its subsidiaries (Tyco

and all its subsidiaries, hereinafter collectively referred to as the ‘‘Company’’ or ‘‘Tyco’’) and have been

prepared in United States dollars and in accordance with generally accepted accounting principles in

the United States (‘‘GAAP’’). Unless otherwise indicated, references in the Consolidated Financial

Statements to 2007, 2006 and 2005 are to Tyco’s fiscal year ended September 28, 2007, September 29,

2006 and September 30, 2005, respectively.

Effective June 29, 2007, Tyco completed the spin-offs of Covidien and Tyco Electronics, formerly

Healthcare and Electronics businesses, respectively, into separate, publicly traded companies (the

‘‘Separation’’) in the form of a distribution to Tyco shareholders. The distribution was made on

June 29, 2007, to Tyco shareholders of record on June 18, 2007, the record date. Each Tyco shareholder

received 0.25 of a common share of each of Covidien and Tyco Electronics for each Tyco common

share held on the record date. Tyco shareholders received cash in lieu of fractional shares for amounts

of less than one Covidien or Tyco Electronics common share. The distribution was structured to be

tax-free to Tyco shareholders except to the extent of cash received in lieu of fractional shares. While we

are a party to Separation and Distribution, Tax Sharing and certain other agreements, we have

determined that there is no significant continuing involvement between us and Covidien or Tyco

Electronics as discussed in Statement of Financial Accounting Standards (‘‘SFAS’’) No. 144,

‘‘Accounting for the Impairment or Disposal of Long-Lived Assets,’’ and Emerging Issues Task Force

(‘‘EITF’’) Issue No. 03-13, ‘‘Applying the Conditions of Paragraph 42 of SFAS No. 144 in Determining

Whether to Report Discontinued Operations.’’ Therefore, we have classified Covidien and Tyco

Electronics as discontinued operations in all periods presented.

Additionally, on the distribution date, the Company, as approved by its Board of Directors,

effected a reverse stock split of Tyco’s common shares, at a split ratio of one for four. Shareholder

approval for the reverse stock split was obtained at the March 8, 2007 Special General Meeting of

Shareholders. Share and per share data for all periods presented have been adjusted to reflect the

reverse stock split.

During 2007 and 2006, the Company incurred pre-tax costs related to the Separation of

$1,083 million and $169 million, respectively. The costs include loss on early extinguishment of debt,

debt refinancing, tax restructuring, professional services and employee-related costs. Of this amount,

$105 million and $49 million is included in separation costs, $259 million in 2007 related to loss on

early extinguishment of debt is included in other expense, net and $719 million and $120 million is

included in discontinued operations, respectively. Additionally, 2007 includes tax charges related to the

Separation primarily for the write-off of deferred tax assets that will no longer be realizable of

$183 million, of which $95 million is included in income taxes and $88 million is included in

discontinued operations.

In connection with the Separation, the Company has realigned its management and segment

reporting structure. See Note 21.

During the first quarter of 2007, we sold Aguas Industriales de Jose, C.A. (‘‘AIJ’’), a joint venture

that was majority owned by Infrastructure Services. Additionally, during the fourth quarter of 2007, the

remaining portion of Infrastructure Services met the held for sale criteria and its results of operations

have been included in discontinued operations for all periods presented.

2007 Financials 103