ADT 2007 Annual Report Download - page 163

Download and view the complete annual report

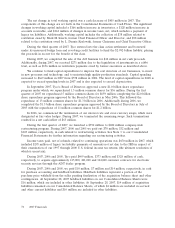

Please find page 163 of the 2007 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.As previously discussed, effective June 29, 2007, the Company completed the Separation. In

connection with the Separation, we paid $349 million in Separation costs during 2007 and $96 million

in 2006, including $256 million and $77 million, respectively, recorded in cash provided by discontinued

operating activities. We expect that we will incur the remaining cash outflows related to the Separation

during the first six months of fiscal 2008. These amounts will primarily consist of tax restructuring,

professional services and employee-related costs.

Capitalization

Shareholders’ equity was $15.6 billion or $31.50 per share, at September 28, 2007, compared to

$35.4 billion or $71.06 per share, at September 29, 2006. Shareholders’ equity decreased $19.8 billion

primarily due to the distribution of Covidien and Tyco Electronics to shareholders. This decrease was

also due to net loss of $1.7 billion, the repurchase of common shares by a subsidiary of $727 million,

and dividends declared of $668 million, offset by favorable changes in foreign currency exchange rates

of $883 million.

In connection with the Separation, as approved by our Board of Directors, we executed a reverse

stock split, and as a result, four Tyco shares were converted into one share. Shareholder approval was

obtained at the March 8, 2007 Special General Meeting of Shareholders.

Our debt levels decreased significantly as compared to September 29, 2006 primarily due to the

debt tenders and Covidien and Tyco Electronics assuming their portion of related borrowings. At

September 28, 2007, total debt decreased $5.1 billion to $4.5 billion, as compared to $9.6 billion at

September 29, 2006. Total debt as a percentage of total capitalization (total debt and shareholders’

equity) was 22% at September 28, 2007, which increased slightly as compared to 21% at September 29,

2006 due to the decrease in shareholders’ equity mentioned above. See Debt Tenders and Bank and

Revolving Credit Facilities below for further discussion.

Our cash balance decreased to $1.9 billion at September 28, 2007, as compared to $2.2 billion at

September 29, 2006. The decrease in cash was primarily due to the debt repayments referred to above

and the class action settlement escrow. These decreases were partially offset by cash flows provided by

operations and transfers from discontinued operations.

As previously discussed, in September 2007, the Board of Directors approved a new $1.0 billion

share repurchase program. Pursuant to the program, we may repurchase Tyco shares from time to time

in open market purchases at prevailing market prices, in negotiated transactions off the market, or

pursuant to an approved 10b5-1 trading plan in accordance with applicable regulations. A Rule 10b5-1

trading plan permits the Company to repurchase its shares during periods when the Company would

not normally be active in the trading market due to insider trading laws, provided the plan is adopted

when the Company is not aware of material non-public information. Under a Rule 10b5-1 trading plan,

we would be unable to repurchase shares above a pre-determined price per share. Additionally, the

maximum number of shares that we may purchase each day would be governed by Rule 10b-18.

Dividend payments were $791 million in 2007. On September 13, 2007 Tyco’s Board of Directors

approved a quarterly dividend on the Company’s common shares of $0.15 per share payable on

November 1, 2007 to shareholders of record of Tyco International Ltd. post Separation on October 1,

2007. The timing, declaration and payment of future dividends to holders of our common shares,

however, falls within the discretion of our Board of Directors and will depend upon many factors,

including the statutory requirements of Bermuda law, our financial condition and results of operations,

the capital requirements of our businesses, industry practice and any other factors the Board of

Directors deems relevant.

2007 Financials 71