ADT 2007 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2007 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

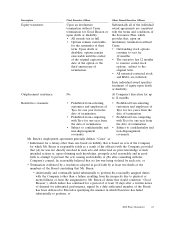

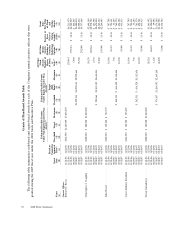

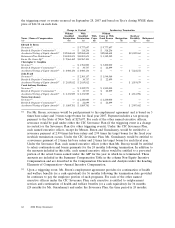

2008 Proxy Statement 53

All Other

Stock All Other Grant

Estimated Possible Payouts Estimated Possible Payouts Awards: Option Date

Under Non-Equity Incentive Plan Under Equity Incentive Plan Number of Awards: Exercise or Fair Value

Awards(2) Awards(3) Shares Number of Base of Stock

Board or Target of Stock Securities Price of and

Committee (Mid- or Underlying Option Option

Grant Approval Threshold Target Maximum Threshold Point) Maximum Units(4) Options(4) Awards(5) Awards

Name Date Date(1) ($) ($) ($) ($) ($) ($) (#) (#) ($/Sh) ($)

(a) (b) (c) (d) (e) (f) (g) (h) (i) (j) (k) (l) (n)

Former Officers

William B. Lytton ........ 11/21/06 11/21/06 $350,000 $ 700,000 $1,575,000

11/21/06 11/21/06 28,326 $1,363,492

11/21/06 11/21/06 94,420 $ 48.14 $1,489,343

06/29/07 07/12/06 1,790 $ 79,429

David E. Robinson ....... 11/21/06 11/21/06 $310,000 $ 620,000 $1,395,000

11/21/06 11/21/06 35,250 $1,696,783

11/21/06 11/21/06 110,157 $ 48.14 $1,737,572

06/29/07 07/12/06 4,532 $ 201,101

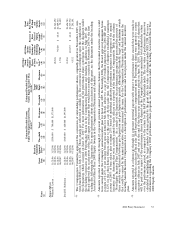

(1) The Compensation Committee approved the conversion of outstanding performance shares, originally granted in November 2005, into

time-based RSUs on July 12, 2006. These awards are reflected in column (j). The conversion was contingent upon the completion of

the Separation, which occurred on June 29, 2007. For more information on the performance share conversion, see the discussion under

the heading Conversion of 2006 Performance Shares in the Compensation Discussion and Analysis. In addition, in May 2007, the

Board approved the acceleration of the 2008 equity award grant that would have normally occurred in November 2007 to the first

trading day following the Separation. For more information about the acceleration of this grant, see the discussion under the heading

Accelerated Fiscal Year 2008 Equity Awards in the Compensation Discussion and Analysis.

(2) Amounts reported in columns (d) through (f) represent potential annual performance bonuses that the named executive officers could

have earned under the Company’s annual incentive plan for fiscal year 2007. In November 2006, the Board approved maximum bonus

payouts of 0.25% of net income before special items for Mr. Breen, subject to a cap of $5.0 million imposed by the 2004 SIP, and

0.12% for the other Senior Officers, subject to the same cap. At the same time, the Compensation Committee established a maximum

payout of 200% of base salary, plus or minus 25% based on individual qualitative performance measures for purposes of the annual

incentive plan. Amounts that were actually earned by such officers are reported in the Summary Compensation Table in the column

‘‘Non-Equity Incentive Plan Compensation.’’ As a result of the Separation, the performance measures that governed the payouts of

these awards were bifurcated between pre-Separation and post-Separation periods, although the threshold, target and maximum awards

that could be earned by the named executive officers remained the same. See the Compensation Discussion and Analysis under the

heading Annual Incentive Compensation for a description of performance measures and actual payouts under the annual incentive

plan.

(3) Amounts reported in columns (g) through (i) represent potential payouts with respect to performance share awards that were made in

connection with the accelerated fiscal year 2008 long-term incentive compensation grant. Performance shares were granted to certain

executive officers in July 2007 and vest at the end of the three-year performance period on June 30, 2010. The number of shares that

will be paid out in respect of the performance shares will depend on the Company’s three-year annualized total shareholder return

over the performance period, as compared to the return for the S&P 500 Industrials index. The fair value of performance shares was

calculated by multiplying the target number of shares granted by the grant date fair value as detemined under FAS 123R. For more

information regarding the Company’s 2008 performance share program, see the discussion under the heading Accelerated Fiscal Year

2008 Equity Awards.