ADT 2007 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2007 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

measures were no longer appropriate and were impractical to administer, and in July 2006 the

Compensation Committee approved the conversion of all outstanding performance shares into

time-based RSUs. The conversion of the RSUs was contingent upon the successful completion of the

Separation. The number of RSUs that each performance share converted into was based on Tyco’s

actual organic revenue growth and ROIC for fiscal year 2006, and the assumption that the performance

goals would be met at the target level for fiscal years 2007 and 2008. The table below sets forth the

performance share payout levels for fiscal year 2006.

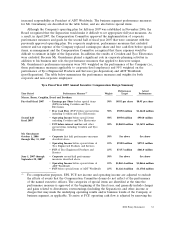

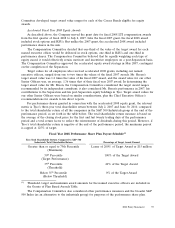

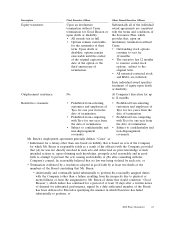

Fiscal Year 2006 Performance Share Goals and Award Payout Levels

Target Actual Threshold Maximum

Performance Performance Performance Award Payout Target Award Award Payout

Measures Weight Level Level Level Payout Level Level

Organic Revenue Growth(1) . . 25% 4.49% 5.4% 50% of Target 100% of Target 200% of Target

ROIC(1) ................ 75% 10.30% 10.51% 50% of Target 100% of Target 200% of Target

(1) The Compensation Committee approved the target organic revenue growth rate as 35% above the

United States’ Gross Domestic Product growth rate over the same period, which equated to

approximately 4.5% organic revenue growth for fiscal 2006. The fiscal year 2006 ROIC target

performance level was based on Tyco’s long-term strategic plan for the corresponding performance

period.

Based on the methodology described in the preceding paragraph and the accompanying table, the

Compensation Committee approved the conversion of the performance shares at 120% of the target

award level at the completion of the Separation. All of the performance shares that converted into

post-Separation Tyco RSUs (or Tyco RSUs, Covidien RSUs and Tyco Electronics RSUs, in the case of

corporate employees) will vest on September 30, 2008. If an employee voluntarily leaves Tyco prior to

September 30, 2008, the RSUs will be forfeited. Employees may be eligible for full or partial vesting of

their RSUs for involuntary termination or for retirement depending on the terms and conditions of the

award agreement and if they are eligible for severance under a severance plan.

Fiscal 2007 and Accelerated Fiscal 2008 Equity Awards

In addition to the conversion of the performance shares, we granted two long-term incentive

awards during fiscal 2007. The annual fiscal year 2007 equity award was granted on November 21, 2006.

The accelerated fiscal year 2008 equity award was granted on the first trading day after the Separation.

LTI compensation for fiscal 2008 was accelerated into the 2007 fiscal year to retain and motivate

employees on a post-Separation basis by aligning their LTI compensation with post-Separation metrics

and goals. Details of these awards are summarized below.

Fiscal Year 2007 Equity Awards

The annual LTI grants for fiscal 2007 took the form of stock options and RSUs. The grant

structure approved by the Compensation Committee in July 2006 was a mix of 50% options and 50%

RSUs. This structure was intended to both enhance employee retention in light of the pending

Separation and minimize share dilution. Performance shares were not used because the Separation

made it impractical to set multi-year goals. The total number of shares available for LTI compensation

grants was capped at 0.9% of shares outstanding on July 12, 2006. In developing target LTI

compensation awards for the named executive officers, the Compensation Committee evaluated the

equity grant practices of our peer group at that time (the pre-Separation peer group). The

Compensation Committee also evaluated internally developed grant ranges prepared by our human

resources department; the performance of the named executive officers during the prior fiscal year; the

amount of equity held by named executive officers; and retention considerations. Using data provided

by consulting firm Watson Wyatt and market data collected from third-party surveys, the Compensation

38 2008 Proxy Statement