ADT 2007 Annual Report Download - page 75

Download and view the complete annual report

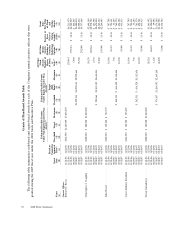

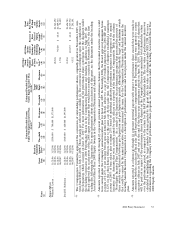

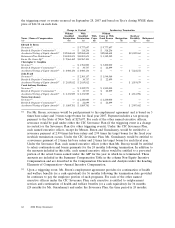

Please find page 75 of the 2007 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The Company took action with respect to three broad-based grants of plan-based equity awards in

fiscal year 2007. The first action was the grant of the annual long-term equity awards for fiscal 2007.

These awards were granted in November 2007 and consisted of stock options and RSUs. The second

action was the conversion of outstanding performance shares into time-based RSUs. The performance

shares were originally granted in November 2005, with vesting and share payouts to occur upon the

expiration of a three-year performance period. In July 2006, the Compensation Committee approved

the conversion of these shares into time-based RSUs, contingent upon the completion of the

Separation. Corporate employees received RSUs of Tyco, Covidien and Tyco Electronics while

non-corporate employees received RSUs in their employing company. All of the replacement RSUs will

vest on September 30, 2008. The methodology for the conversion of performance shares into RSUs is

described in the Compensation Discussion and Analysis under the heading Conversion of 2006

Performance Shares. The final action was the grant of the annual long-term equity awards for fiscal

2008. The Board approved the acceleration of this award from November 2007 to the first trading day

immediately following the Separation. The purpose of the acceleration was to provide equity to our

employees and executives that is tied to Company results from the date of the Separation. The award

consisted of stock options, RSUs and performance shares. For more information about the acceleration

of this grant, see the discussion under the heading Accelerated Fiscal Year 2008 Equity Awards in the

Compensation Discussion and Analysis.

The exercise price of stock options equals the fair market value of our common stock on the date

of grant. For fiscal 2007 equity awards, fair market value was calculated as the average of the high and

low market price on the NYSE on the grant date. For fiscal 2008 equity awards, fair market value was

calculated as the closing price on the NYSE on the grant date. Stock options generally vest in equal

installments over a period of four years, beginning on the first anniversary of the grant date. Each

option holder has ten years to exercise his or her stock option from the date of grant, unless forfeited

earlier. Forfeiture provisions for the named executive officers are described under the heading ‘‘Change

in Control and Severance Benefits’’ in the Compensation Discussion and Analysis.

RSUs generally vest over a period of four years, in three equal installments beginning on the

second anniversary of the grant. RSUs earn dividend equivalent units during the vesting period and do

not carry voting rights until they are settled in shares. Forfeiture provisions with respect to RSUs for

the named executive officers are described under the heading ‘‘Change in Control and Severance

Benefits’’ in the Compensation Discussion and Analysis.

Performance shares generally vest in full at the end of the performance period. The number of

shares that are paid out in respect of each performance share depends on whether, and at what level,

the performance criteria have been met. Performance shares do not accrue dividends prior to vesting

and do not have any voting rights. For a description of the performance criteria associated with the

outstanding performance shares held by the named executive officers, see the discussion regarding the

accelerated fiscal 2008 equity awards under the heading ‘‘Fiscal 2007 and Accelerated Fiscal 2008

Equity Awards’’ in the Compensation Discussion and Analysis.

2008 Proxy Statement 55