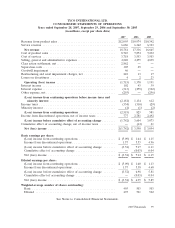

ADT 2007 Annual Report Download - page 196

Download and view the complete annual report

Please find page 196 of the 2007 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.TYCO INTERNATIONAL LTD.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

1. Basis of Presentation and Summary of Significant Accounting Policies (Continued)

References to the segment data are to the Company’s continuing operations. Prior period amounts

have been reclassified to exclude the results of discontinued operations.

Principles of Consolidation—Tyco is a holding company which conducts its business through its

operating subsidiaries. The Company consolidates companies in which it owns or controls more than

fifty percent of the voting shares or has the ability to control through similar rights. Also, the Company

consolidates variable interest entities in which the Company bears a majority of the risk to the entities’

expected losses or stands to gain from a majority of the entities’ expected returns. All intercompany

transactions have been eliminated. The results of companies acquired or disposed of during the year

are included in the Consolidated Financial Statements from the effective date of acquisition or up to

the date of disposal.

Use of Estimates—The preparation of the Consolidated Financial Statements in conformity with

GAAP requires management to make estimates and assumptions that affect the reported amount of

assets and liabilities, disclosure of contingent assets and liabilities and reported amounts of revenues

and expenses. Significant estimates in these Consolidated Financial Statements include restructuring

charges, allowances for doubtful accounts receivable, estimates of future cash flows associated with

asset impairments, useful lives for depreciation and amortization, loss contingencies, net realizable

value of inventories, fair values of financial instruments, estimated contract revenue and related costs,

legal liabilities, income taxes and tax valuation allowances, and pension and postretirement employee

benefit expenses. Actual results could differ materially from these estimates.

Revenue Recognition—The Company recognizes revenue principally on four types of transactions—

sales of products, sales of security systems, billings for monitoring and maintenance services and

contract sales.

Revenue from the sales of products is recognized at the time title and risks and rewards of

ownership pass. This is generally when the products reach the free-on-board shipping point, the sales

price is fixed and determinable and collection is reasonably assured.

Provisions for certain rebates, sales incentives, trade promotions, product returns and discounts to

customers are accounted for as reductions in determining sales in the same period the related sales are

recorded. These provisions are based on terms of arrangements with direct, indirect and other market

participants. Rebates are estimated based on sales terms, historical experience and trend analysis.

Sales of security monitoring systems may have multiple elements, including equipment, installation,

monitoring services and maintenance agreements. Amounts assigned to each component of the

arrangement are based on that component’s objectively determined fair value. If fair value cannot be

objectively determined for a sale involving multiple elements, the Company recognizes the revenue

from installation of services, along with the associated direct incremental costs, over the contract life.

Revenue from the sale of services is recognized as services are rendered. Customer billings for

services not yet rendered are deferred and recognized as revenue as the services are rendered and the

associated deferred revenue is included in current liabilities or long-term liabilities, as appropriate.

Contract sales for the installation of fire protection systems, large security intruder systems and

other construction-related projects are recorded primarily under the percentage-of-completion method.

Profits recognized on contracts in process are based upon estimated contract revenue and related total

cost of the project at completion. The extent of progress toward completion is generally measured

based on the ratio of actual cost incurred to total estimated cost at completion. Revisions to cost

104 2007 Financials