ADT 2007 Annual Report Download - page 245

Download and view the complete annual report

Please find page 245 of the 2007 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.TYCO INTERNATIONAL LTD.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

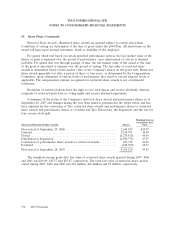

19. Share Plans (Continued)

prices for the Tyco awards were adjusted. Generally, employee share options converted into share

options of the employer with the exception of corporate employees whose awards converted into share

options of all three companies. The revisions made to the share options as a result of the Separation

constituted a modification under the provisions of SFAS No. 123R which requires a comparison of fair

values of the share options immediately before the Separation and the fair values immediately after the

Separation. In certain instances, the fair value immediately after the separation was higher. As a result,

the modification will result in incremental compensation cost of $18 million. Of this amount,

$13 million was recorded in the third quarter of 2007 for vested share options ($11 million in

discontinued operations) and $2 million will be recorded in continuing operations over the remaining

vesting period of the share options. The continuing operations impact was included in separation costs.

Except for the changes described, the principal terms of the share options remain unchanged from the

original grant.

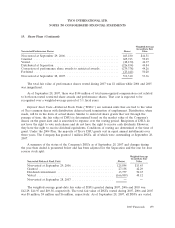

Also in connection with the Separation, Tyco employee restricted share awards and restricted stock

units (collectively, ‘‘restricted share awards’’) were modified through the issuance of Covidien and Tyco

Electronics restricted shares or the conversion to shares of the employer. Restricted shares and

restricted share units held by employees in the company in which they are not employed are subject to

accelerated vesting provisions and vest 50% on the first day of trading after the Separation and 50% six

months thereafter. This accelerated vesting will result in $14 million of accelerated compensation

expense for Tyco’s continuing operations. Tyco recorded $12 million as selling, general and

administrative expenses in the fourth quarter of 2007 and will record the remaining expense in the first

quarter of 2008. Equity awards under the Save-As-You-Earn Plan (the ‘‘SAYE Plan’’) were not

modified in connection with the Separation thereby resulting in additional compensation expense of

$14 million, $5 million of which was recorded in 2007 ($2 million in discontinued operations), with the

balance to be recorded over the remaining vesting period. Except for the changes described, the

principal terms and conditions of restricted shares, restricted units and deferred stock units of the

employees remain unchanged from the original grant.

The Company amended the terms of performance based awards granted on November 22, 2005 to

provide for vesting of the remaining awards without regard to the original performance measures. The

original performance awards, which were previously adjusted to reflect the attainment of performance

metrics through fiscal year 2006, were converted to time based restricted stock units of the employer,

with the exception of corporate employees whose outstanding awards were converted to time based

restricted stock units of the three separate companies.

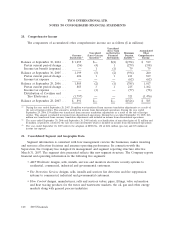

Effective October 1, 2005, the Company adopted the provisions of SFAS No. 123R using the

modified prospective transition method. Under this transition method, the compensation cost

recognized beginning October 1, 2005 includes compensation cost for (i) all share-based payments

granted prior to, but not yet vested as of October 1, 2005, based on the grant-date fair value estimated

in accordance with the original provisions of SFAS No. 123, and (ii) all share-based payments granted

subsequent to September 30, 2005 based on the grant-date fair value estimated in accordance with the

provisions of SFAS No. 123R. Compensation cost is generally recognized ratably over the requisite

service period or period to retirement eligibility, if shorter. Prior period amounts have not been

restated for the adoption of SFAS No. 123R.

2007 Financials 153