ADT 2007 Annual Report Download - page 201

Download and view the complete annual report

Please find page 201 of the 2007 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.TYCO INTERNATIONAL LTD.

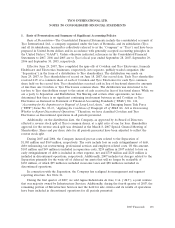

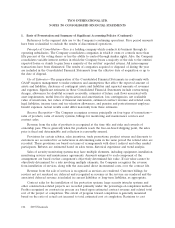

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

1. Basis of Presentation and Summary of Significant Accounting Policies (Continued)

Environmental Costs—Tyco is subject to laws and regulations relating to protecting the

environment. Tyco provides for expenses associated with environmental remediation obligations when

such amounts are probable and can be reasonably estimated.

Income Taxes—Deferred tax liabilities and assets are recognized for the expected future tax

consequences of events that have been reflected in the Consolidated Financial Statements. Deferred tax

liabilities and assets are determined based on the differences between the book and tax bases of

particular assets and liabilities and operating loss carryforwards, using tax rates in effect for the years in

which the differences are expected to reverse. A valuation allowance is provided to offset deferred tax

assets if, based upon the available evidence, it is more likely than not that some or all of the deferred

tax assets will not be realized.

Insurable Liabilities—The Company records liabilities for its workers’ compensation, product,

general and auto liabilities. The determination of these liabilities and related expenses is dependent on

claims experience. For most of these liabilities, claims incurred but not yet reported are estimated by

utilizing actuarial valuations based upon historical claims experience. Certain insurable liabilities are

discounted using a risk-free rate of return when the pattern and timing of the future obligation is

reliably determinable. The impact of the discount on the Consolidated Balance Sheets at September 28,

2007 and September 29, 2006 was to reduce the obligation by $38 million and $47 million, respectively.

The Company maintains captive insurance companies to manage certain of its insurable liabilities.

Additionally, the Company records receivables from third party insurers when recovery has been

determined to be probable.

Financial Instruments—The Company may use interest rate swaps, currency swaps and forward and

option contracts to manage risks generally associated with foreign exchange rate and interest rate risk.

Derivatives used for hedging purposes are designated and effective as a hedge of the identified risk

exposure at the inception of the contract. Accordingly, changes in fair value of the derivative contract

are highly correlated with changes in the fair value of the underlying hedged item at inception of the

hedge over the life of the hedge contract.

All derivative financial instruments are reported on the Consolidated Balance Sheets at fair value.

Derivatives used to economically hedge foreign currency denominated balance sheet items are reported

in selling, general and administrative expenses along with offsetting transaction gains and losses on the

items being hedged. Gains and losses on net investment hedges are included in the cumulative

translation adjustment component of other comprehensive income to the extent they are effective.

Gains and losses on derivatives designated as cash flow hedges are recorded in other comprehensive

income and reclassified to earnings in a manner that matches the timing of the earnings impact of the

hedged transactions. The ineffective portion of all hedges, if any, is recognized currently in earnings.

Instruments that do not qualify for hedge accounting are marked to market with changes recognized in

current earnings.

Share Premium and Contributed Surplus—In accordance with the Bermuda Companies Act 1981,

when Tyco issues shares for cash at a premium to their par value, the resulting premium is credited to

a share premium account, a non-distributable reserve. Contributed surplus, subject to certain

conditions, is a distributable reserve.

Reclassifications—Certain prior year amounts have been reclassified to conform with current year

presentation. In 2007, the Company presented proceeds from the divestiture of businesses classified as

discontinued operations within net cash used in discontinued investing activities. Such proceeds were

2007 Financials 109