ADT 2007 Annual Report Download - page 144

Download and view the complete annual report

Please find page 144 of the 2007 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

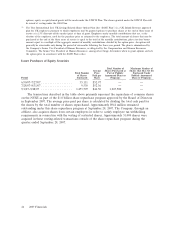

Under the terms of the Separation and Distribution Agreement entered into in connection with

the Separation, each of Tyco, Covidien and Tyco Electronics are jointly and severally liable for the full

amount of the class action settlement and any judgments resulting from opt-out claims. Additionally,

under the Separation and Distribution Agreement, the companies share in the liability and related

escrow accounts, with Tyco assuming 27%, Covidien 42% and Tyco Electronics 31% of the settlement

amount.

Tyco incurred a charge to expense, for which no tax benefit is available, and a current liability of

$2.975 billion in 2007. The Company has also recovered or expects to recover certain of these costs

from insurers. As such, the Company recorded $113 million of recoveries in connection with the class

action settlement in its Consolidated Statements of Operations. Tyco borrowed under its unsecured

bridge and credit facilities to fund the liability and placed the proceeds in escrow for the benefit of the

class. In connection with the Separation, Covidien and Tyco Electronics assumed their portion of the

related borrowing. The escrow accounts will earn interest that is payable to the class. Interest is also

accrued on the class action settlement liability. Based on the Separation and Distribution Agreement, at

September 28, 2007 Tyco had a receivable from Covidien and Tyco Electronics for their portion of the

liability of $1,257 million and $927 million, respectively, and a payable to Covidien and Tyco Electronics

for their interest in the escrow accounts. Receivables and payables that pertain to the class action

settlement and related escrow accounts with the same counterparty are presented net in the

consolidated balance sheet. Tyco’s portion of the liability is $808 million. Additionally, Tyco has paid

$73 million and recorded payables of $9 million at September 28, 2007, with an offset to shareholders’

equity for amounts due to Covidien and Tyco Electronics for their portion of the insurance recovery.

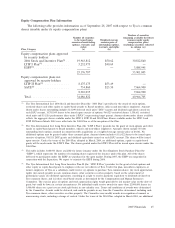

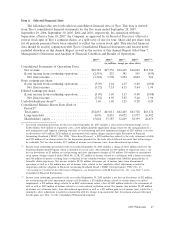

Operating Results

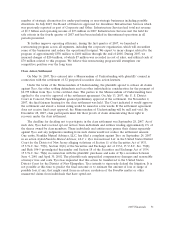

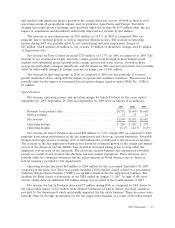

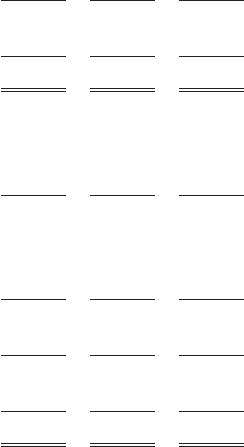

Net revenue and net income for the years ended September 28, 2007, September 29, 2006 and

September 30, 2005 were as follows ($ in millions):

2007 2006 2005

Revenue from product sales .......................... $12,095 $10,974 $10,342

Service revenue ................................... 6,686 6,362 6,323

Net revenue ...................................... $18,781 $17,336 $16,665

Operating (loss) income ............................. $(1,715) $ 1,370 $ 1,191

Interest income .................................... 102 43 39

Interest expense ................................... (313) (279) (322)

Other expense, net ................................. (255) — (296)

(Loss) income from continuing operations before income taxes

and minority interest .............................. (2,181) 1,134 612

Income taxes ..................................... (334) (310) (29)

Minority interest ................................... (4) (1) (2)

(Loss) income from continuing operations ................ (2,519) 823 581

Income from discontinued operations, net of income taxes .... 777 2,781 2,492

(Loss) income before cumulative effect of accounting change . . . (1,742) 3,604 3,073

Cumulative effect of accounting change, net of income taxes . . . — (14) 21

Net (loss) income .................................. $(1,742) $ 3,590 $ 3,094

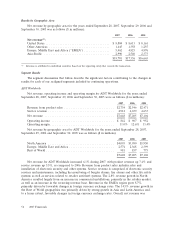

Net revenue increased $1.4 billion, or 8.3%, for 2007 as compared to 2006 as a result of growth in

all of our segments. The increase in net revenue was largely driven by Flow Control as a result of

volume growth from continued strength in most industrial end markets. In addition, ADT Worldwide

had strong growth in Asia and Latin America, as well as growth in its recurring revenue base and

52 2007 Financials