ADT 2007 Annual Report Download - page 200

Download and view the complete annual report

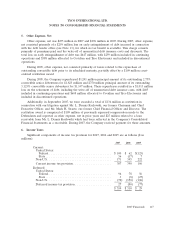

Please find page 200 of the 2007 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.TYCO INTERNATIONAL LTD.

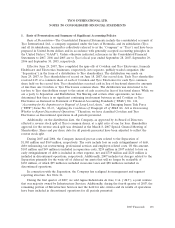

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

1. Basis of Presentation and Summary of Significant Accounting Policies (Continued)

economic benefit that is expected to be obtained from the customer relationship. Effective as of the

beginning of the third quarter of 2007, Tyco changed the estimated useful life of dealer intangibles in

geographical areas comprising approximately 90% of the net carrying value of dealer intangibles from

12 to 15 years. The Company continues to amortize dealer intangible assets on an accelerated basis.

The change in the estimated useful life used to account for dealer intangibles resulted from our

ongoing analysis of all pertinent factors, including actual customer attrition data, demand, competition,

and the estimated technological life of the installed systems. The pertinent factors have been influenced

by management’s ongoing customer retention programs, as well as tactical and strategic initiatives to

improve service delivery, customer satisfaction, and the credit worthiness of the subscriber customer

base. In accordance with SFAS No. 154, the change in estimated useful life of dealer intangibles is

accounted for prospectively. The effect of the change in estimated useful life for dealer intangibles

decreased loss from continuing operations and net loss by $6 million each and increased basic and

diluted earnings per share by $0.01 for 2007.

Other contracts and related customer relationships, as well as intellectual property consisting

primarily of patents, trademarks and unpatented technology, are amortized on a straight-line basis over

four to forty years. The Company evaluates the amortization methods and remaining useful lives of

intangible assets on a periodic basis to determine whether events and circumstances warrant a revision

to the amortization method or remaining useful lives.

Investments—The Company invests in debt and equity securities. Long-term investments in

marketable equity securities that represent less than twenty percent ownership are marked to market at

the end of each accounting period. Unrealized gains and losses are credited or charged to other

comprehensive income within shareholders’ equity for available for sale securities unless an unrealized

loss is deemed to be other than temporary, in which case such loss is charged to earnings. Management

determines the proper classification of investments in debt obligations with fixed maturities and equity

securities for which there is a readily determinable market value at the time of purchase and

reevaluates such classifications as of each balance sheet date. Realized gains and losses on sales of

investments are included in the Consolidated Statements of Operations.

Other equity investments for which the Company does not have the ability to exercise significant

influence and for which there is not a readily determinable market value are accounted for under the

cost method of accounting. Each reporting period, the Company periodically evaluates the carrying

value of its investments accounted for under the cost method of accounting, such that they are

recorded at the lower of cost or estimated net realizable value. For equity investments in which the

Company exerts significant influence over operating and financial policies but do not control, the equity

method of accounting is used. The Company’s share of net income or losses of equity investments is

included in the Consolidated Statements of Operations and was not material in any period presented.

Product Warranty—The Company records estimated product warranty costs at the time of sale.

Manufactured products are warranted against defects in material and workmanship when properly used

for their intended purpose, installed correctly, and appropriately maintained. Generally, product

warranties are implicit in the sale; however, the customer may purchase an extended warranty.

Manufactured equipment is also warranted in the same manner as product warranties. However, in

most instances the warranty is either negotiated in the contract or sold as a separate component.

Warranty period terms range from 90 days (e.g., various products) up to 15 years (e.g., pressure

reducers and floor heating products). The warranty liability is determined based on historical

information such as past experience, product failure rates or number of units repaired, estimated cost

of material and labor, and in certain instances estimated property damage.

108 2007 Financials