ADT 2007 Annual Report Download - page 241

Download and view the complete annual report

Please find page 241 of the 2007 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.TYCO INTERNATIONAL LTD.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

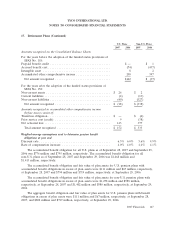

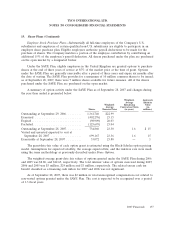

17. Retirement Plans (Continued)

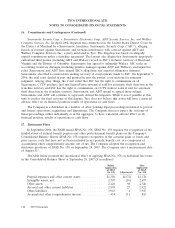

The Company also participates in a number of multi-employer defined benefit plans on behalf of

certain employees. Pension expense related to multi-employer plans was $3 million, $3 million and

$12 million in 2007, 2006 and 2005, respectively.

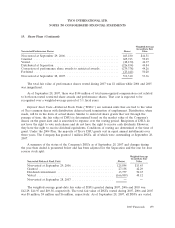

Executive Retirement Arrangements—Messrs. Kozlowski and Swartz participated in individual

Executive Retirement Arrangements maintained by Tyco (the ‘‘ERA’’). Under the ERA,

Messrs. Kozlowski and Swartz would have fixed lifetime benefits commencing at their normal

retirement age of 65. The Company’s accrued benefit obligations for Messrs. Kozlowski and Swartz as

of September 28, 2007 were $71 million and $36 million, respectively. The Company’s accrued benefit

obligations for Messrs. Kozlowski and Swartz as of September 29, 2006 were $66 million and

$34 million, respectively. Retirement benefits are available at earlier ages and alternative forms of

benefits can be elected. Any such variations would be actuarially equivalent to the fixed lifetime benefit

starting at age 65. Amounts owed to Messrs. Kozlowski and Swartz under the ERA are in dispute by

the Company.

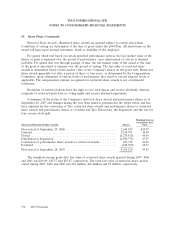

Defined Contribution Retirement Plans—The Company maintains several defined contribution

retirement plans, which include 401(k) matching programs, as well as qualified and nonqualified profit

sharing and share bonus retirement plans. Expense for the defined contribution plans is computed as a

percentage of participants’ compensation and was $78 million, $73 million and $67 million for 2007,

2006 and 2005, respectively. The Company also maintains an unfunded Supplemental Executive

Retirement Plan (‘‘SERP’’). This plan is nonqualified and restores the employer match that certain

employees lose due to IRS limits on eligible compensation under the defined contribution plans.

Expense related to the SERP was $3 million in 2007, $2 million in 2006 and $3 million in 2005.

Deferred Compensation Plans—The Company has nonqualified deferred compensation plans, which

permit eligible employees to defer a portion of their compensation. A record keeping account is set up

for each participant and the participant chooses from a variety of measurement funds for the deemed

investment of their accounts. The measurement funds correspond to a number of funds in the

Company’s 401(k) plans and the account balance fluctuates with the investment returns on those funds.

Deferred compensation expense was $13 million, $6 million and $7 million in 2007, 2006 and 2005,

respectively. Total deferred compensation liabilities were $100 million and $91 million at September 28,

2007 and September 29, 2006, respectively.

Rabbi Trusts—The Company has rabbi trusts, the assets of which may be used to pay non-qualified

plan benefits. The trusts primarily hold corporate-owned life insurance policies, cash and cash

equivalents, and debt and equity securities. During 2007, the Company, as permitted under the trust

agreement, sold substantially all of the assets from one of the trusts and received $271 million of

proceeds. At September 28, 2007 and September 29, 2006, trust assets totaled $2 million and

$265 million, respectively. The cash surrender value of the life insurance policies, net of outstanding

loans, included in the rabbi trust was $224 million at September 29, 2006. The rabbi trust assets, which

are consolidated, are subject to the claims of the Company’s creditors in the event of the Company’s

insolvency. Plan participants are general creditors of the Company with respect to these benefits.

Postretirement Benefit Plans—The Company generally does not provide postretirement benefits

other than pensions for its employees. However, certain acquired operations provide these benefits to

employees who were eligible at the date of acquisition, and a small number of U.S. and Canadian

operations provide on going eligibility for such benefits.

2007 Financials 149