ADT 2007 Annual Report Download - page 271

Download and view the complete annual report

Please find page 271 of the 2007 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

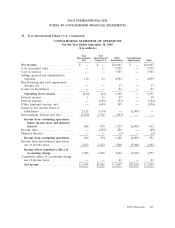

NON-GAAP MEASURES

FREE CASH FLOW RECONCILIATION

(in US$ millions) 2005 2006 2007

Net cash provided by operating activities $ 2,327 $ 1,993 $ 1,836

Decrease in sale of accounts receivable programs 8 8 7

Capital expenditures, net (463) (519) (646)

Acquisition of customer accounts (ADT dealer program) (328) (373) (409)

Purchase accounting and holdback liabilities (14) (7) (10)

Voluntary pension contributions 83 — 23

FREE CASH FLOW $ 1,613 $ 1,102 $ 801

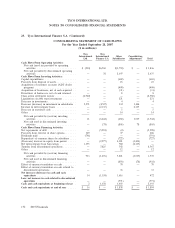

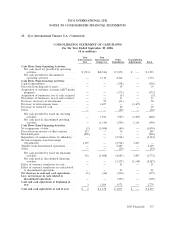

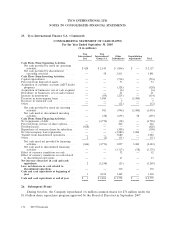

2005 OPERATING INCOME (LOSS) BEFORE SPECIAL ITEMS

FIRE ELECTRICAL

ADT PROTECTION FLOW SAFETY & METAL CORPORATE OPERATING

(in US$ millions) WORLDWIDE SERVICES CONTROL PRODUCTS PRODUCTS AND OTHER INCOME

OPERATING INCOME (LOSS) $ 952 $ 202 $ 336 $ 278 $ 295 $ (872) $ 1,191

Divestiture Losses 11 4 2 6 23

SEC Settlement 50 50

Legacy Contingencies/Former Executives 70 70

OPERATING INCOME (LOSS) BEFORE SPECIAL ITEMS $ 963 $ 206 $ 336 $ 280 $ 295 $ (746) $ 1,334

2006 OPERATING INCOME (LOSS) BEFORE SPECIAL ITEMS

FIRE ELECTRICAL

ADT PROTECTION FLOW SAFETY & METAL CORPORATE OPERATING

(in US$ millions) WORLDWIDE SERVICES CONTROL PRODUCTS PRODUCTS AND OTHER INCOME

OPERATING INCOME (LOSS) $ 907 $ 239 $ 356 $ 202 $ 319 $ (653) $ 1,370

Separation costs (1) 50 49

Losses on divestitures 2 2

Reduction in estimated workers’ compensation liabilities (48) (48)

Voluntary Replacement Program 100 100

Former Management Settlement (72) (72)

OPERATING INCOME (LOSS) BEFORE SPECIAL ITEMS $ 909 $ 238 $ 356 $ 302 $ 319 $ (723) $ 1,401

“Organic revenue growth,” “free cash fl ow” (FCF), “operating income before

special items,” “operating margin before special items,” “operating income from

continuing operations before special items,” and “EPS from continuing operations

before special items” are non-GAAP measures and should not be considered

replacements for GAAP results.

Organic revenue growth is a useful measure used by the Company to mea-

sure the underlying results and trends in the business. The difference between

reported net revenue growth (the most comparable GAAP measure) and organic

revenue growth (the non-GAAP measure) consists of the impact from foreign

currency, acquisitions and divestitures, and other changes that do not refl ect the

underlying results and trends. Organic revenue growth is a useful measure of

the Company’s performance because it excludes items that: i) are not completely

under management’s control, such as the impact of foreign currency exchange;

or ii) do not refl ect the underlying growth of the Company, such as acquisition

and divestiture activity. It may be used as a component of the Company’s com-

pensation programs. The limitation of this measure is that it excludes items that

have an impact on the Company’s revenue. This limitation is best addressed by

using organic revenue growth in combination with the GAAP numbers.

FCF is a useful measure of the Company’s cash which is free from any

signifi cant existing obligation. The difference between cash fl ows from operat-

ing activities (the most comparable GAAP measure) and FCF (the non-GAAP

measure) consists mainly of signifi cant cash outfl ows that the Company believes

are useful to identify. FCF permits management and investors to gain insight into

the number that management employs to measure cash that is free from any

signifi cant existing obligation. It is also a signifi cant component in the Company’s

incentive compensation plans. The difference refl ects the impact from:

• the sale of accounts receivable programs,

• net capital expenditures,

• acquisition of customer accounts (ADT dealer program),

• cash paid for purchase accounting and holdback liabilities, and

• voluntary pension contributions.

The impact from the sale of accounts receivable programs and voluntary

pension contributions is added or subtracted from the GAAP measure because

this activity is driven by economic fi nancing decisions rather than operating

activity. Capital expenditures and the ADT dealer program are subtracted because

they represent long-term commitments. Cash paid for purchase accounting

and holdback liabilities is subtracted from Cash Flow from Operating Activities

because these cash outfl ows are not available for general corporate uses. The

limitation associated with using FCF is that it subtracts cash items that are ulti-

mately within management’s and the Board of Directors’ discretion to direct and

that therefore may imply that there is less or more cash that is available for the

Company’s programs than the most comparable GAAP measure. This limitation is

best addressed by using FCF in combination with the GAAP cash fl ow numbers.

FCF as presented herein may not be comparable to similarly titled measures

reported by other companies. The measure should be used in conjunction with

other GAAP fi nancial measures. Investors are urged to read the Company’s fi nancial

statements as fi led with the SEC, as well as the accompanying tables in this annual

report that show the reconciliation of FCF to Cash Flows from Operating Activities

(the most comparable GAAP measure).

The Company has presented its operating income, operating margin and EPS

from continuing operations before special items. Special Items include charges

and gains that may mask the underlying operating results and/or business trends

of the Company or business segment, as applicable. The Company utilizes these

fi nancial measures before special items to assess overall operating performance,

segment level core operating performance and to provide insight to manage-

ment in evaluating overall and segment operating plan execution and underlying

market conditions. Operating income from continuing operations before special

items is also a signifi cant component in the Company’s incentive compensation

plans. Operating income, operating margin and EPS from continuing operations

before special items are useful measures for investors because they permit more

meaningful comparisons of the Company’s underlying operating results and busi-

ness trends between periods. The difference between these measures and the

most comparable GAAP measures (operating income, operating margin and EPS

from continuing operations) consists of the impact of charges and gains related to

divestitures, acquisitions, restructurings (including transaction costs related to the

separations of Tyco Electronics and Covidien into separate public companies), and

other income or charges that may mask the underlying operating results and/or

business trends. The limitation of these measures is that they exclude the impact

(which may be material) of items that increase or decrease the Company’s reported

operating income, operating margin and EPS from continuing operations. This

limitation is best addressed by using these fi nancial measures in combination with

the most comparable GAAP measures in order to better understand the amounts,

character and impact of any increase or decrease on reported results.

Design: VSA Partners, New York Photos: Nat Clymer, Mike Hemberger, Mark Power Printing: CGI North America.

Cover and pages 1-12 were printed on 20% post-consumer recycled Forest Stewardship Council certified paper. The financial pages were printed on 30% post-consumer recycled paper.