ADT 2007 Annual Report Download - page 71

Download and view the complete annual report

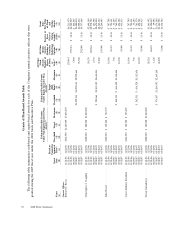

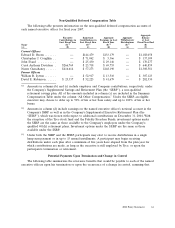

Please find page 71 of the 2007 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.purposes of the Summary Compensation Table, the aggregate incremental pre-tax cost to the

Company for personal use of Company aircraft is calculated using a method that takes into

account the incremental cost of fuel, trip-related maintenance, crew travel expenses, on-board

catering, landing fees, trip-related hangar/parking costs and other variable costs. Because our

aircraft are used primarily for business travel, the calculation does not include the fixed costs that

do not change based on usage, such as pilots’ salaries, the acquisition costs of the Company-owned

or leased aircraft, and the cost of maintenance not related to trips.

(d) The amounts in this column for Messrs. Gursahaney, Evard, Davidson and Robinson represent tax

gross-up payments made with respect to taxable insurance benefits and relocation expenses.

Amounts for Messrs. Breen and Lytton include tax gross-up payments made with respect to taxable

insurance benefits as well as the reimbursement of State taxes owed by them to New York or New

Jersey for Tyco work performed in those States. Generally, the Company pays the increased tax

cost (including a gross-up) that each executive owes as a result of working in those States rather

than their principal work location. Amounts related to State taxes for Messrs. Breen and Lytton

are estimated amounts, pending receipt of the relevant personal State tax return information for

calendar year 2007. These estimates are based primarily on compensation payable in fiscal year

2007 to Messrs. Breen and Lytton and the estimated amount of such compensation attributable to

New York and New Jersey services, respectively, based on information previously provided to the

Company by Messrs. Breen and Lytton.

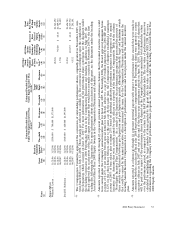

(e) The amounts in this column represent severance benefits payable to Messrs. Lytton and Robinson

upon their separation from the Company in July and August, respectively. Mr. Lytton’s severance

benefit is based on the terms set forth in his employment agreement, and consisted of:

(i) a severance cash payment equal to two years of his base salary and two times his target

annual bonus, which totaled $2,800,000;

(ii) a prorated portion of his target annual bonus for fiscal 2007, or $1,070,137;

(iii) two additional years of service for the purpose of estimating his supplemental retirement

benefit, or $2,200,000; and

(iv) continued health and insurance benefits (or cash equivalent) for three years following his date

of termination, which calculated at the Company’s cost is equal to $215,892.

Mr. Robinson’s severance benefits were determined pursuant to the Tyco International (US) Inc.

Executive Severance Plan and consisted of:

(i) a severance cash payment equal to two years of his base salary and two times his target

annual bonus, which totaled of $2,480,000;

(ii) a prorated portion of his target annual bonus for fiscal 2007, or $967,006; and

(iii) continued health and insurance benefits and outplacement services (or cash equivalent) for

two years, which calculated at the Company’s cost is equal to $29,125.

(f) Retirement plan contributions include matching contributions made by the Company on behalf of

the executive to the Company’s tax-qualified 401(k) Retirement, Savings and Investment Plan and

the non-qualified Supplement Savings and Retirement Plan.

(g) Miscellaneous compensation includes matching charitable contributions made by the Company on

behalf of each of the named executive officers except for Mr. Evard and Mr. Lytton. Each of these

contributions was in an amount less than or equal to $10,000. Miscellaneous compensation for

Messrs. Evard, Davidson, Gursahaney and Robinson include reimbursement of relocation expenses

of approximately $5,300, $6,900, $4,700 and $153,000 respectively.

2008 Proxy Statement 51