ADT 2007 Annual Report Download - page 149

Download and view the complete annual report

Please find page 149 of the 2007 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

end markets with significant project growth in the energy and water sectors. Growth in these sectors

was strong across all geographical regions, and, in particular, Asia-Pacific and Europe. Favorable

changes in foreign currency exchange rates positively impacted revenue by $197 million while the net

impact of acquisitions and divestitures unfavorably impacted net revenue by $16 million.

The increase in operating income of $101 million, or 28.4%, in 2007 as compared 2006 was

primarily due to revenue growth, as well as improved utilization rates. The increase in operating

income during 2007 was partially offset by net restructuring and asset impairment charges of

$25 million, which includes $6 million in cost of sales, $3 million of divestiture charges, and $1 million

of Separation costs.

Net revenue for Flow Control increased $329 million, or 11.7%, in 2006 as compared to 2005. The

increase in net revenue was largely driven by volume growth from strength in most industrial end

markets with substantial project growth in the energy, process and water sectors. Growth in these

sectors was particularly strong in Asia-Pacific and the Americas. The increases in revenue were partially

offset by unfavorable changes in foreign currency exchange rates of $43 million.

The increase in operating income in 2006 as compared to 2005 was due primarily to revenue

growth mentioned above, along with the impact of operational excellence initiatives. This increase was

partially offset by the impact of incremental stock option charges required under SFAS No. 123R of

$7 million.

Safety Products

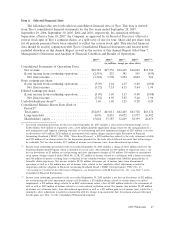

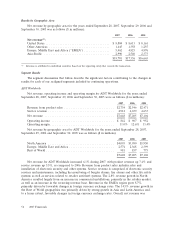

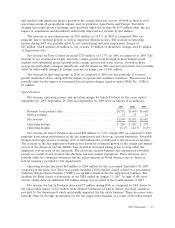

Net revenue, operating income and operating margin for Safety Products for the years ended

September 28, 2007, September 29, 2006 and September 30, 2005 were as follows ($ in millions):

2007 2006 2005

Revenue from product sales ............................. $1,752 $1,660 $1,668

Service revenue ...................................... 15 15 14

Net revenue ........................................ $1,767 $1,675 $1,682

Operating income .................................... $ 286 $ 202 $ 278

Operating margin ..................................... 16.2% 12.1% 16.5%

Net revenue for Safety Products increased $92 million, or 5.5%, during 2007 as compared to 2006

primarily from strong performance in the fire suppression and electronic security businesses. Favorable

changes in foreign currency exchange rates of $48 million also contributed to the increase in revenue.

The increase in the fire suppression business was driven by continued growth in the energy and marine

sectors in the Americas and the Middle East as well as increased selling prices to help offset the

significant cost increase of raw materials. The electronic security business also experienced favorable

growth as a result of new product introductions and new market expansions. These increases were

partially offset by continued softness in the life safety business in North America due to delays of

federal assistance provided to fire departments.

Operating income increased $84 million to $286 million for the year ended September 28, 2007

compared to the prior year. Prior year results included a $100 million charge related to a pre-existing

Voluntary Replacement Program (‘‘VRP’’) for sprinkler heads in the fire suppression business. The

deadline for filing claims to participate in the VRP ended on August 31, 2007. In light of the most

current claims data, an additional $10 million charge was recorded in the fourth quarter of 2007.

Net revenue for Safety Products decreased $7 million during 2006 as compared to 2005 driven by

the unfavorable impact of $56 million from divested businesses as well as delays of federal assistance

provided to fire departments which unfavorably impacted the life safety business. These decreases were

partially offset by stronger performance in the fire suppression business as a result of favorable market

2007 Financials 57