ADT 2007 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2007 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Company’s cost of the supplemental insurances for Mr. Breen in connection with his termination, as set

forth by his employment agreement.

Cash Perquisite Allowance Plan

Our cash perquisite allowance plan, implemented in 2003, replaced our prior executive perquisites

programs. Those programs had provided a number of benefits to our executives (including company

cars, club dues and tax preparation services) that were costly and administratively burdensome. The

current plan provides our Senior Officers with a cash payment equal to 10% of their annual base

salary, up to a maximum annual benefit of $70,000. Senior Officers receive their cash perquisite

allowance in four quarterly installments. We do not restrict the types of expenses to which the

allowance can be applied.

Use of Corporate Aircraft

Mr. Breen and the other Senior Officers are permitted to use corporate aircraft or chartered

aircraft for business travel. Mr. Breen is the only executive currently pre-approved to use Company

aircraft for non-business purposes, although other named executive officers may do so in exceptional

circumstances if expressly approved by the Board or Mr. Breen.

Tax Deductibility of Executive Compensation

Section 162(m) of the Internal Revenue Code imposes a limit of $1 million on the amount of

compensation that can be deducted by Tyco with respect to the named executive officers (other than

Mr. Coughlin, our chief financial officer). This limitation does not apply to compensation that qualifies

as ‘‘performance-based’’ under federal tax law. It is our policy to structure compensation arrangements

with our executive officers to qualify as performance-based so that compensation payments are

deductible under federal tax law, unless the benefit of such deductibility is outweighed by the need for

flexibility or the attainment of other corporate objectives, such as the recruitment and retention of key

employees. Non-deductible forms of compensation include payments in connection with the recruitment

and retention of key employees, discretionary bonus payments and grants of RSUs. In addition, stock

options granted to Mr. Breen when he was hired in July 2002 may not qualify for deduction under

Section 162(m). Immediately following the Separation, Mr. Breen held approximately 1.8 million of these

post-Separation options to purchase common stock of each of Tyco, Covidien and Tyco Electronics.

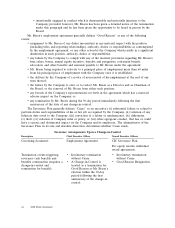

Change in Control and Severance Benefits

We view severance benefits as very useful tools that help the Company retain key executives. We

believe that our severance arrangements are competitive with similar arrangements provided to

executive officers at other large publicly traded U.S. companies. Mr. Breen’s employment agreement

provides for benefits if he is terminated in connection with a change in control or under other specified

circumstances. For our other named executive officers, the Tyco International (US) Inc. Severance Plan

for U.S. Officers and Executives (the ‘‘Severance Plan’’) and the Tyco International (US) Inc.

Change-in-Control Severance Plan for Certain U.S. Officers and Executives (the ‘‘CIC Severance

Plan’’) generally govern the benefits that accrue upon termination. As described below, a ‘‘double

trigger’’ is required under the CIC Severance Plan before benefits become available to the executives

covered by that plan. Because Mr. Breen is the only current named executive officer whose benefits are

governed by his employment agreement, which was originally entered into in 2002 when the Company’s

prospects were uncertain, the value of the payments and the circumstances under which they are made

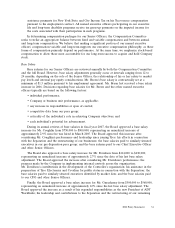

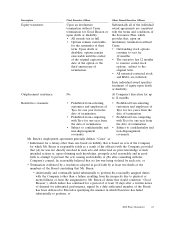

differ from those applicable to our other named executive officers. The key terms and provisions of our

severance plans are summarized in the following table. In addition, refer to the Potential Payments

Upon Termination and Change in Control Table for the estimated dollar value of the benefits described

below for our current named executive officers.

2008 Proxy Statement 41