ADT 2007 Annual Report Download - page 230

Download and view the complete annual report

Please find page 230 of the 2007 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.TYCO INTERNATIONAL LTD.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

16. Commitments and Contingencies (Continued)

claims expected to be filed over the next seven years. The Company believes that it has adequate

amounts recorded related to these matters. While it is not possible at this time to determine with

certainty the ultimate outcome of these asbestos-related proceedings, the Company believes that the

final outcome of all known and anticipated future claims, after taking into account its substantial

indemnification rights and insurance coverage, will not have a material adverse effect on the Company’s

financial position, results of operations or cash flows.

Income Taxes

In connection with the spin-offs of Covidien and Tyco Electronics from Tyco, Tyco entered into a

Tax Sharing Agreement that generally governs Covidien’s, Tyco Electronics’ and Tyco’s respective rights,

responsibilities, and obligations after the distribution with respect to taxes, including ordinary course of

business taxes and taxes, if any, incurred as a result of any failure of the distribution of all of the shares

of Covidien or Tyco Electronics to qualify as a tax-free distribution for U.S. federal income tax

purposes within the meaning of Section 355 of the Code or certain internal transactions undertaken in

anticipation of the spin-offs to qualify for tax-favored treatment under the Code.

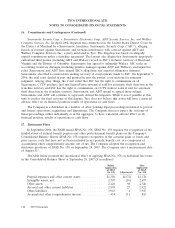

Under the Tax Sharing Agreement, with certain exceptions, Tyco generally is responsible for the

payment of 27% of any additional U.S. income taxes that are required to be paid to a U.S. tax

authority as a result of a U.S. tax audit of Covidien’s, Tyco Electronics’ or Tyco’s subsidiaries’ income

tax returns for all periods prior to the spin-offs.

Under the Tax Sharing Agreement, the Company shares responsibility for certain of Tyco’s,

Covidien’s and Tyco Electronics’ income tax liabilities based on a sharing formula for periods prior to

and including June 29, 2007. More specifically, Tyco, Covidien and Tyco Electronics share 27%, 42%

and 31%, respectively, of U.S. income tax liabilities that arise from adjustments made by tax authorities

to Tyco’s, Covidien’s and Tyco Electronics’ U.S. income tax returns. All costs and expenses associated

with the management of these shared tax liabilities are shared equally among the parties. At

September 28, 2007, Tyco has recorded a receivable from Covidien and Tyco Electronics of $103 million

reflected in other assets as our estimate of their portion of the Tax Sharing obligations with an offset to

shareholders’ equity. Other liabilities include $543 million for the fair value of Tyco’s obligations under

the Tax Sharing Agreement, determined in accordance with FIN 45 recognized with an offset to

shareholders’ equity.

Tyco will provide payment under the Tax Sharing Agreement as the shared income tax liabilities are

settled. Settlement is expected to occur as the IRS audit process is completed for the impacted years. Given

the nature of the shared liabilities, the maximum amount of potential future payments is not determinable.

In the event the Separation is determined to be taxable and such determination was the result of

actions taken after the Separation by Tyco, Covidien or Tyco Electronics, the party responsible for such

failure would be responsible for all taxes imposed on Tyco, Covidien or Tyco Electronics as a result

thereof. If such determination is not the result of actions taken after the Separation by Tyco, Covidien

or Tyco Electronics, then Tyco, Covidien and Tyco Electronics would be responsible for 27%, 42% and

31%, respectively, of any taxes imposed on Tyco, Covidien or Tyco Electronics as a result of such

determination. Such tax amounts could be significant. The Company is responsible for all of its own

taxes that are not shared pursuant to the Tax Sharing Agreement’s sharing formula. In addition,

138 2007 Financials