ADT 2007 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2007 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

effects of the sale of accounts receivable programs, cash paid for purchase accounting and

holdback liabilities and voluntary pension contributions. For fiscal year 2007, the approved

categories of adjustments at the corporate level included elimination of the effects of (i) business

disposals, (ii) charges for the early extinguishment of debt, (iii) charges and income related to

former management or shareholder litigation, (iv) certain income tax adjustments, (v) goodwill or

other intangible asset impairments, (vi) new accounting pronouncements and the cumulative effect

of change in accounting policy, (vii) restructuring and asset impairment charges and

(viii) Separation-related expenses. Similar adjustments were authorized for the performance

measures governing Mr. Gursahaney’s bonus at the operating unit levels.

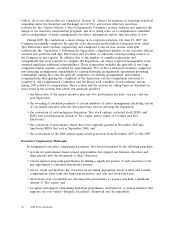

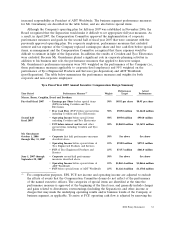

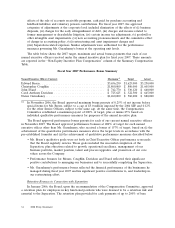

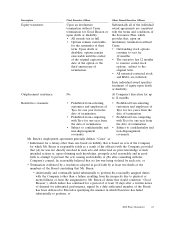

The table below shows the 2007 target, maximum and actual bonus payments that each of our

named executive officers received under the annual incentive plan for fiscal year 2007. These amounts

are reported in the ‘‘Non-Equity Incentive Plan Compensation’’ column of the Summary Compensation

Table.

Fiscal Year 2007 Performance Bonus Summary

Named Executive Officer (Current) Maximum(1) Target Actual

Edward Breen ..................................... $3,656,250 $1,625,000 $3,250,000

Christopher Coughlin ............................... $1,800,000 $ 800,000 $1,605,000

John Evard ....................................... $ 742,770 $ 330,120 $ 660,000

Carol Anthony Davidson ............................. $ 725,625 $ 322,500 $ 645,000

Naren Gursahaney .................................. $1,260,000 $ 560,000 $ 880,000

(1) In November 2006, the Board approved maximum bonus payouts of 0.25% of net income before

special items for Mr. Breen, subject to a cap of $5.0 million imposed by the 2004 SIP, and 0.12%

for the other Senior Officers, subject to the same cap. At the same time, the Compensation

Committee established a maximum payout of 200% of target, plus or minus 25% based on

individual qualitative performance measures for purposes of the annual incentive plan.

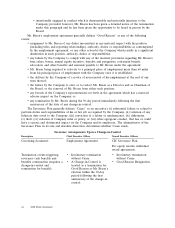

The Board approved performance bonus payouts for each of our current named executive officers

in November 2007. The Board approved performance bonuses at 200% of target for each named

executive officer other than Mr. Gursahaney, who received a bonus of 157% of target, based on (i) the

achievement of the quantitative performance measures above the target levels in accordance with the

pre-established formulas and (ii) the achievement of qualitative performance measures described below:

• Mr. Breen’s qualitative goals were set forth in Chief Executive Officer performance scorecards

that the Board regularly reviews. Those goals included the successful completion of the

Separation, plus objectives related to growth, operational excellence, management of our

business portfolio, market position, talent and process upgrades, and promotion of our core

values across the Company.

• Performance bonuses for Messrs. Coughlin, Davidson and Evard reflected their significant

positive contributions to managing our businesses and to successfully completing the Separation.

• Mr. Gursahaney’s performance bonus reflected the financial performance of the businesses he

managed during fiscal year 2007 and his significant positive contributions to, and leadership in,

our restructuring effort.

Retention Bonuses in Connection with Separation

In January 2006, the Board, upon the recommendation of the Compensation Committee, approved

a retention plan for employees in key functional positions who were deemed to be a retention risk and

essential to the Separation. The retention plan provided for cash payments of up to 200% of base

34 2008 Proxy Statement