ADT 2007 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2007 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274

|

|

5

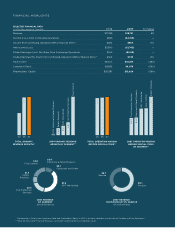

before special items improved in each of our business

segments except for Electrical and Metal Products. The

decline in that segment was due to lower metal spreads

(the difference between the selling prices of our products

and the original cost of raw materials).

Free cash fl ow—which gives us signifi cant fl exibility

to invest in our businesses and to have cash available for

other purposes—totaled $801 million for fi scal 2007 and

included approximately $322 million of net payments

for special items. Tyco has consistently shown the ability

to generate strong cash fl ow, and this is an important area

of focus for our management team.

The fi nancial fl exibility provided by our free cash fl ow

also enables us to return capital to our shareholders. In

September, we initiated a new $1 billion share repurchase

program, which we expect to complete during fi scal 2008.

Additionally, beginning in November, we increased our

quarterly dividend by 36%, to 15 cents per share.

THE NEW TYCO

While the separation has streamlined the company, we

continue to have considerable breadth and depth in our

portfolio. Our businesses hold market-leading positions

in large and growing global industries. Because these

industries are highly fragmented, they offer additional

opportunities for growth.

About half our fi scal 2007 revenues were generated

outside the United States. With 118,000 employees in

more than 60 countries, we operate on a vast geographical

scale that includes important emerging markets. Among

such markets are high-growth economies such as China

and India, where the opportunities for our company

are substantial.

The company is organized around the following fi ve

business segments:

•ADT Worldwide, the world’s largest provider of elec-

tronic security products and alarm-monitoring services

to residential, commercial, industrial and government

customers.

•Fire Protection Services, the industry leader in fi re detec-

tion, fi re suppression and special-hazard solutions for

commercial, industrial and institutional customers.

•Safety Products, a major global provider of fi re protec-

tion, intrusion security, access control, video manage-

ment, electronic surveillance systems and breathing

apparatuses (for fi refi ghters and other fi rst responders).

•Flow Control, the world’s leader in providing valves,

fi ttings, valve automation, heat-tracing solutions and pipes

for the oil and gas, power, food and beverage, chemical,

water and wastewater, and other process industries.

•Electrical and Metal Products, a major provider of steel

tubes, armored wire and cable, and other metal

products for construction, electrical, fi re and secu-

rity, mechanical and automotive customers.

To better capitalize on the opportunities we see ahead, we

have set a number of strategic goals for the company. These

include expanding the leadership position of our businesses

through organic growth and targeted acquisitions; broad-

ening our range of products and services; continuing to

focus our portfolio; increasing our presence in emerging

markets; and enhancing our effi ciency through Operational

Excellence initiatives.

During 2007, we made selective acquisitions (an area

of limited activity in recent years) to improve our product

CHAIRMAN’S LETTER

: