ADT 2007 Annual Report Download - page 137

Download and view the complete annual report

Please find page 137 of the 2007 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

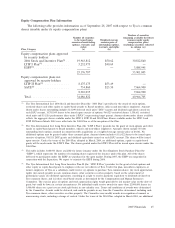

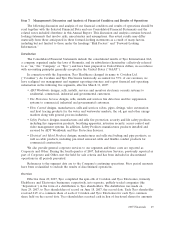

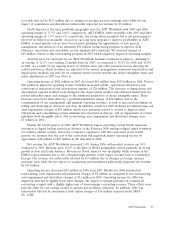

Equity Compensation Plan Information

The following table provides information as of September 28, 2007 with respect to Tyco’s common

shares issuable under its equity compensation plans:

Number of securities

Number of securities remaining available for future

to be issued upon Weighted-average issuance under equity

exercise of outstanding exercise price of compensation plans

options, warrants and outstanding options, (excluding securities reflected

rights warrants and rights in column (a))

Plan Category (a) (b) (c)

Equity compensation plans approved

by security holders:

2004 Stock and Incentive Plan(1) . . 19,943,812 $50.62 30,812,860

LTIP I Plan(2) ............... 5,232,975 $40.69 —

ESPP(3) .................... — — 3,088,945

25,176,787 33,901,805

Equity compensation plans not

approved by security holders:

LTIP II Plan(4) .............. 8,175,175 $53.49 —

SAYE(5) ................... 734,860 $23.30 7,064,900

8,910,035 7,064,900

Total ...................... 34,086,822 40,966,705

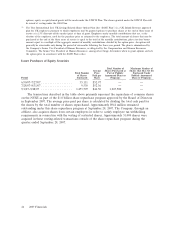

(1) The Tyco International Ltd. 2004 Stock and Incentive Plan (the ‘‘2004 Plan’’) provides for the award of stock options,

restricted shares and other equity or equity-based awards to Board members, officers and non-officer employees. Amount

shown under shares outstanding includes 114,299 deferred stock unit (‘‘DSU’’) grants and dividend equivalents earned on

each DSU account, 14,783,049 shares to be issued upon exercise of options, 964,523 restricted shares, 3,550,631 restricted

stock units and 531,310 performance share units (‘‘PSUs’’) representing target payout. Amount shown under shares available

reflects the aggregate shares available under the LTIP I, LTIP II and 2004 Plans. Shares available under the LTIP I and

LTIP II Plans in March 2004 were rolled into the 2004 Plan as of the inception of the Plan.

(2) The Tyco International Ltd. Long Term Incentive Plan (the ‘‘LTIP I Plan’’) provides for the grant of stock options and other

equity or equity-based grants to Board members, officers and non-officer employees. Amounts shown exclude 567,486

outstanding stock options assumed in connection with acquisitions at a weighted-average exercise price of $64.61. No

additional options may be granted under those assumed plans. Amount shown includes 4,318,622 shares to be issued upon

exercise of options, 914,353 DSU grants, and dividend equivalents earned on each DSU account. The shares will be issued

upon exercise. Under the terms of the 2004 Plan, adopted in March, 2004, no additional options, equity or equity-based

grants will be made under the LTIP I Plan. The shares granted under the LTIP I Plan will be issued upon exercise under the

2004 Plan.

(3) This table includes 3,088,945 shares available for future issuance under the Tyco Employee Stock Purchase Plan (the

‘‘ESPP’’), which represents the number of remaining shares registered for issuance under this plan. All of the shares

delivered to participants under the ESPP are purchased in the open market. During 2007, the ESPP was suspended in

connection with the Separation. We expect to reinstate the ESPP during 2008.

(4) The Tyco International Ltd. Long Term Incentive Plan II (the ‘‘LTIP II Plan’’) provides for the grant of stock options and

other equity or equity-based grants to employees who are not officers of Tyco. Under this plan, non-officer employees or

former employees of Tyco or a subsidiary could receive: (i) options to purchase Tyco common shares; (ii) stock appreciation

rights; (iii) awards payable in cash, common shares, other securities or other property, based on the achievement of

performance goals; (iv) dividend equivalents, consisting of a right to receive payments equivalent to dividends declared on

Tyco common shares; and (v) other stock-based awards as determined by the Compensation and Human Resources

Committee. The exercise price of options and stock appreciation rights would generally be fair market value on the date of

grant, but could be lower in certain circumstances. No individual could receive awards for more than 12,000,000 shares (or

3,000,000 shares on a post reverse stock split basis) in any calendar year. Terms and conditions of awards were determined

by the Committee. Awards could be deferred, and could be payable in any form the Committee determined, including cash,

Tyco common shares, other securities or other property. The Committee may modify awards in recognition of unusual or

nonrecurring events, including a change of control. Under the terms of the 2004 Plan, adopted in March 2004, no additional

2007 Financials 45