ADT 2007 Annual Report Download - page 83

Download and view the complete annual report

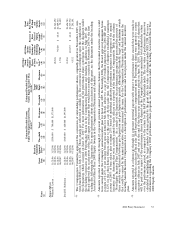

Please find page 83 of the 2007 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.(3) Amounts represent the intrinsic value of all unvested equity awards and stock options of Tyco that

would vest upon a triggering event. For Mr. Breen, the amounts under columns (b), (c) and

(e) include a tax gross-up payment to the State of New York of $71,500, and the amount under

column (g) includes such a payment in the amount of $60,681. The amounts in column (g) for

each named executive officer include the prorated portion of the performance shares that were

granted as part of the accelerated 2008 equity award. These amounts are based on the number of

months of service that would have been completed in the performance period as of the date of the

triggering event and assuming target performance is achieved.

Amounts do not include the intrinsic value of unvested equity awards and stock options of Tyco

Electronics or Covidien that would be accelerated upon the occurrence of a triggering event. Based

on a September 28, 2007 closing stock price of $35.43 for Tyco Electronics and $41.50 for

Covidien, such amounts would be:

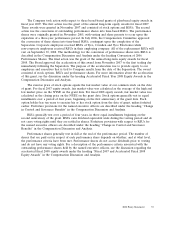

• for Mr. Breen, approximately $2.8 million with respect to unvested equity of Tyco

Electronics and approximately $3.4 million with respect to unvested equity of Covidien in

the event of a change in control with or without a qualified termination, death or disability,

or in the event of termination without cause by the Company or resignation with good

reason by the executive;

• for Mr. Coughlin, approximately $1.4 million with respect to unvested equity of Tyco

Electronics and approximately $1.8 million with respect to unvested equity of Covidien in

the event of a change in control with or without a qualified termination or in the event of

death or disability; outside of a change in control, approximately $250,000 of such equity

would vest upon a termination without cause by the Company or resignation with good

reason by the executive;

• for Mr. Evard, approximately $157,000 with respect to unvested equity of Tyco Electronics

and approximately $196,000 with respect to unvested equity of Covidien in the event of a

change in control with or without a qualified termination or in the event of death or

disability;

• for Mr. Davidson, approximately $303,000 with respect to unvested equity of Tyco

Electronics and approximately $380,000 with respect to unvested equity of Covidien in the

event of a change in control with or without a qualified termination or in the event of death

or disability; outside of a change in control, approximately $35,000 of such equity would vest

upon a termination without cause by the Company or resignation with good reason by the

executive;

• for Mr. Gursahaney, approximately $110,000 with respect to unvested equity of Tyco

Electronics and approximately $129,000 with respect to unvested equity of Covidien in the

event of a change in control with or without a qualified termination or in the event of death

or disability.

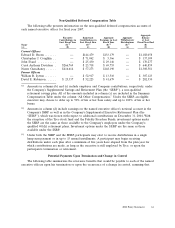

(4) Outside of a change in control, termination by the Company without Cause or by Mr. Breen for

Good Reason, if Mr. Breen voluntarily terminates before age 60, benefits deemed earned under

his pension plan (the Supplemental Executive Retirement Plan) will be subject to a reduction of

0.25% for each month or partial month that the termination date precedes age 60, and an

additional 0.25% for each month or partial month that he commences payment of the benefit prior

to age 60. Pursuant to Mr. Breen’s employment agreement, such a reduction is not applicable after

a change in control. The amount shown in column (b) reflects the increase in value without such a

reduction.

(5) In the event of a change in control, Mr. Breen’s employment agreement provides for a full

gross-up of any federal excise tax that might be due under Section 4999 of the Internal Revenue

2008 Proxy Statement 63